- China's yuan not far from a 4 month high - policy support, COVID recovery, seasonal demand

- China to pause costly chip investments as Covid strains budget

- PBOC Guangzhou branch reportedly guides banks to provide offshore financing to developers

- ICYMI - China's Finance Minister reiterated plans to appropriately expand fiscal spending

- BOJ Gov Kuroda says again will continue to ease monetary policy to hit inflation target

- Tokyo Gas unit nears $4.6 billion deal to buy U.S. natgas producer

- ANZ on another potential tailwind for the yen - Has the Japan Import Price Index turned?

- Federal Reserve Federal Open Market Committee (FOMC) December minutes due Wednesday

- China COVID peak? Nearly a dozen major Chinese cities are reporting recovery in subway use

- BOJ unscheduled JGB buying operation again today to control yields

- PBOC sets USD/ CNY central rate at 6.9131 (vs. estimate at 6.9133)

- ING on why demand for yuan in the onshore market should increase

- Japan manufacturing PMI for December (final) 48.9 (vs. prior 49.0)

- PBOC is expected to set the USD/CNY reference rate at 6.9133 – Reuters estimate

- UK data: Shop price index December 7.3% y/y (prior 7.4%). Food prices up a record 13.3%

- Nikkei reports that Japan PM Kishida will review price target accord with next BOJ chief

- Ex-CFO pleads guilty to stealing $5mn to trade meme stocks, cryptos (& lose it all)

- US politics update - House of Representatives adjourned, failed to elect a new Speaker

- Nikkei says Chip glut to last most of 2023, but automotive crunch persists

- ICYMI - ECB's Kazaks sees room for significant interest rates hikes in February and March

- Economic calendar in Asia on Wednesday, 4 January 2023, a fairly light one

- Trade ideas thread - Wednesday, 4 January 2023

- Declines for the major US indices to start the trading year

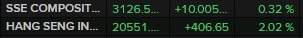

It was a very light news and data day from the Asian timezone, with a few market-positive items out of China. China’s yuan has already moved towards 4-month highs while stockmarkets, both on the mainland and in Hong Kong, rose on the session.

The positives from China included (in the bullets above but collated here):

1. policy support for the economy:

2. A potential bounce out of COVID:

3. Seasonal demand:

4. More property market support (some sources are reporting this as "China is reportedly mulling measures to shore up "too big to fail" developers"):

AUD, NZD and CAD were beneficiaries, rising during the session against the USD. EUR and GBP were also supported.

USD/JPY popped early but has come back to be just a little lower on the day. The Bank of Japan bought Japanese Government Bonds in an unscheduled operation for the 4th session in a row.

Chinese shares: