- The "bias index" for the RBA is showing aggressive rate hike forecasts are being unwound

- Australian August business confidence rises to 10 from prior 7

- PBOC sets USD/ CNY reference rate for today at 6.8928 (vs. estimate at 6.9080)

- China Securities Daily - Analysts expect the PBoC to maintain the MLF rate at 2.75%

- Morgan Stanley has cut its forecast for Brent crude for Q3 to $98 / barrel, from $110

- Australian Westpac Consumer Sentiment rises 3.9% m/m (prior -3%)

- US CPI for August - preview

- BoK Dep Gov says closely monitoring FX markets, says that volatility is likely to increase

- Japan data: August PPI 9.0% y/y (expected 8.9%)

- USD/JPY BOJ intervention watch - intervention seen as unlikely without US coordination

- Australia consumer confidence weekly survey drops 0.5% w/w

- Making sense of your senses in your trading

- Japan may launch a nationwide travel incentive this month

- New Zealand data: August Food Price Index +1.1% m/m (prior +2.1%)

- Goldman Sachs on US railroad strike - "I don't think its a black swan"

- Forexlive Americas FX news wrap: US inflation expectations slide

- Here's how the recently-below-parity EUR/USD could turn to technically bullish

- BoA says the falling yen has overshot its fundamentals but its a "falling knife"

- Trade ideas thread - Tuesday, 13 September 2022

- US major indices close higher for the 4th consecutive day

Major forex rates moved in limited ranges only ahead of the US inflation data that is due at 1230 GMT:

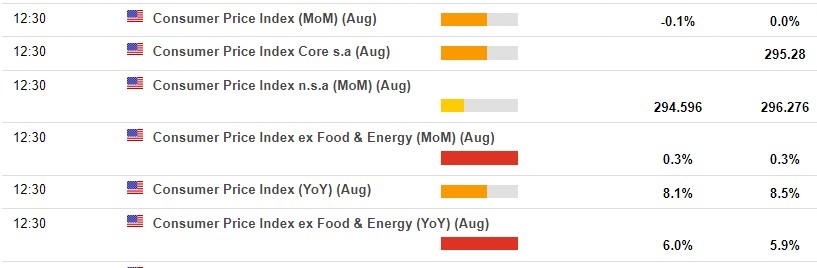

- This snapshot is from the ForexLive economic data calendar, access it here.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the 'prior' (previous month/quarter as the case may be) result. The number in the column next to that, where is a number, is the consensus median expected.

Regional equities followed the US market lead, US equities rose for the fourth day on Monday. Optimism is up that US inflation is showing signs of peaking. Optimism is also up that the 75bp rate hike expected from the Federal Open Market Committee (FOMC) at next week’s meeting, September 20 & 21, will be last of the super-sized hikes. We’ll see.

On the data front we had Japanese wholesale inflation, the PPI for August. This rose again both m/m (but below the median estimate) and y/y (ahead of the median estimate). A dropping yen is not helping businesses in Japan with import prices.

Also today we had a little encouragement from the National Australia Bank Business Survey. Confidence improved, and conditions were broadly stable. Capacity constraints were also relatively stable, albeit at elevated levels. Ditto for cost pressures.

Comments on the yen from Japanese officials have been absent, so far at least, today. USD/JPY is little net changed on the session circa 142.50 and thereabouts.