- BOJ official confirms the BOJ will maintain its loose monetary policy

- Oil price is getting hitting lower.

- China March CPI 1.5% y/y (expected 1.2%) & PPI 8.3% y/y (expected 7.9%)

- People’s Bank of China sets yuan reference rate at 6.3645 (vs. estimate at 6.3647)

- China reports over 27,000 new coronavirus cases for April 10

- BOJ Governor Kuroda says Japan's financial system is stable as a whole - can ease further

- USD/JPY is climbing ahead of Bank of Japan Governor Kuroda speaking later today

- ICYMI - Goldman Sachs warns Fed may hike to above 4%

- South Korean exports for the first 10 days of April shoot higher y/y

- China coronavirus - Shanghai reports a record high new case count above 26,000

- UK media reports that both Finland and Sweden are set to join NATO soon

- EUR/USD under 1.09 again - earlier gap higher being filled in

- China - Building firm Zhenro has missed a bond coupon payment and warns it may miss more

- New Zealand data - March retail sales -1.3% m/m (prior -7.8%

- French presidential election latest count is Macron 27.4%, Le Pen 24.8%

- RBNZ shadows are 'sharply divided' over the interest rate hike this week: 25 or 50bp

- Huawei is suspending all orders in Russia

- French presidential election: Macron 27.4%, Le Pen 25.5% (counting continues)

- Weekend comments from Fed's Mester - rate hikes will cool demand

- UK - the latest Defence Intelligence update on the situation in Ukraine

- EUR/USD above 1.09 in very early Asia trade

- AUD traders heads up - Australian federal election will be held on May 21

- Monday morning open levels - indicative forex prices - 11 April 2022

- China reports another record in covid cases as discontent in Shanghai grows

- The earnings calendar restarts next week (I can't believe it)

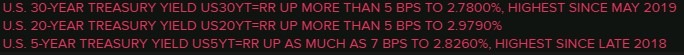

The 10 year US Treasury yield is higher, hitting 2.76% for the first time since pre-pandemic (back in early 2019). Yield gains were spread more widely too:

Speaking of yields, in China its 10-year yield fells below that for the US for the first time in 12 years (since 2010).

Otherwise it was an active session. EUR/USD traded to above 1.0930 in the very early hours of Monday (when it was only New Zealand FX active, and early for them even). The French presidential election was cited (round 1). Macron came out ahead in this vote, but it was very, very close and eyes will be on the April 24 second round of votes, the run-off for the presidency. EUR/USD spent the balance of the session retracing this ‘gap’ to be very little net changed on the session as I post.

Other currencies have net lost ground against a strong US dollar. CAD has been further kicked by the fall in oil prices on Sunday evening US time futures trade.

- AUD, NZD, GBP, CHF are all down against the dollar on the session.

As is yen, with USD/JPY approaching, but not piercing, 125.00. Both Governor Kuroda and the official who heads up the monetary policy unit of the Bank of Japan reitereated today, in separate sets of comments, that the BOJ remains committed to its ultra-loose monetary policy and will ease even further if it sees fit.

The Shanghai COVID-19 outbreak worsened, cases mounted to new daily highs again over the weekend, for the two days in succession. Food shortages continue, as do widespread protests. There is no end to the lockdown of the city in sight. Jilin remains in its month-long+ lockdown. Cases are rising in Guangzhou.