- There are a few USD/JPY option expiries to note today, Tuesday 03 May 2022

- Hong Kong is easing coronavirus restrictions

- Its not clear if Alibaba's founder Jack Ma has been arrested, but BABA shares are plunging

- Citi acknowledged that one of its trading desks was behind a flash crash in Europe Monday

- Former top Fed policy staffer suggests neutral rate could be 5%

- RBA previews

- Australian weekly consumer confidence survey - collapses to 90.7 (prior 96.5)

- Soaring inflation data continues - South Korea core inflation highest in 9 years

- New Zealand Building Permits for March +5.8% m/m ( prior 12.2%)

- BlackRock says US both Core CPI & PCE inflation peaked in March and February, respectively

- Morgan Stanley see "meaningful downside" for the S&P500

- Opinion piece says "this is not your grandfather’s Fed". (Is that a good thing???)

- Preview - BoA are focused on Powell's press conference following the FOMC statement

- Barclays FOMC preview - 50bp hike already signaled - eyeing Powell's press conference

- Trade ideas thread - Tuesday 03 May 2022

- US official says tools to address price surges are being considered (but there's a but)

- NASDAQ index/other indices rebound higher to start the month of May

- Forexlive Americas FX news wrap: US 10-year yields touch 3%

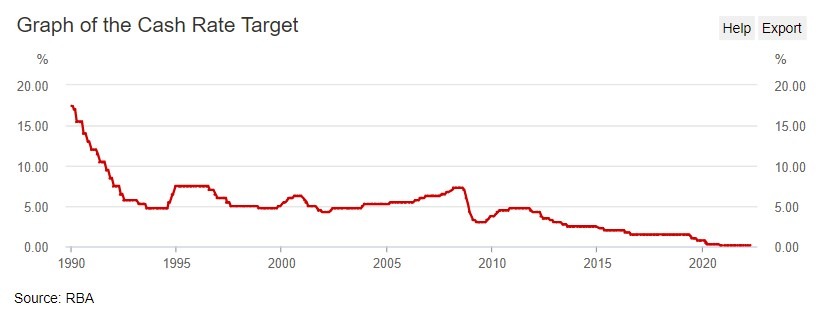

The Reserve Bank of Australia policy decision is due at 0430 GMT on 3 May. Analyst consensus is for a 15bp rate hike while market pricing has baked in a 15bp hike. The current cash rate target is 0.10%. Its been over 11 years since the last cash rate increase:

There are previews of the RBA in the bullets above. Expectations of a hike are not unanimous amongst analysts.

It was a holiday in Japan, Singapore and China today, which thinned out forex liquidity. There were some sharp moves during the timezone, notably rises for AUD, NZD, and CAD. GBP, EUR and JPY all showed some gains also. There was little fresh news of impact, and thus no clear news-related catalyst to account for the rapid gains for AUD, NZD, & CAD.

US equity index futures also traded higher (overnight US time trade).