- US equity close: Not a pretty picture but off the lows

- Putin speech rescheduled 8 am in Moscow

- BOC's Beaudry: Bank will continue to do whatever is necessary to restore price stability

- A little-known but scary fact about Vladimir Putin

- ECB's Lagarde: We will not let this phase of high inflation feed into economic behaviour

- US treasury sells $12B of 20 year bonds at a high yield of 3.820%

- European equity close: Nearing the June lows

- Atlanta Fed GDPNow 3Q tracker 0.3% vs 0.5% last

- The 2025 dot plot will be one to watch

- GDT price index $4072, up 2.0%

- Bitcoin back below $19000. MicroStrategy continues to buy.

- Is this the $TELL?

- US 10-year yields make a break over 3.5%

- JPM's Dimon: The US economy is strong on jobs and consumer spending but there are risks

- Russia mulls partial mobilization and martial law - report

- US August housing starts 1.575M vs. 1.445M estimate

- Canada August CPI 7.0% y/y vs 7.3% expected

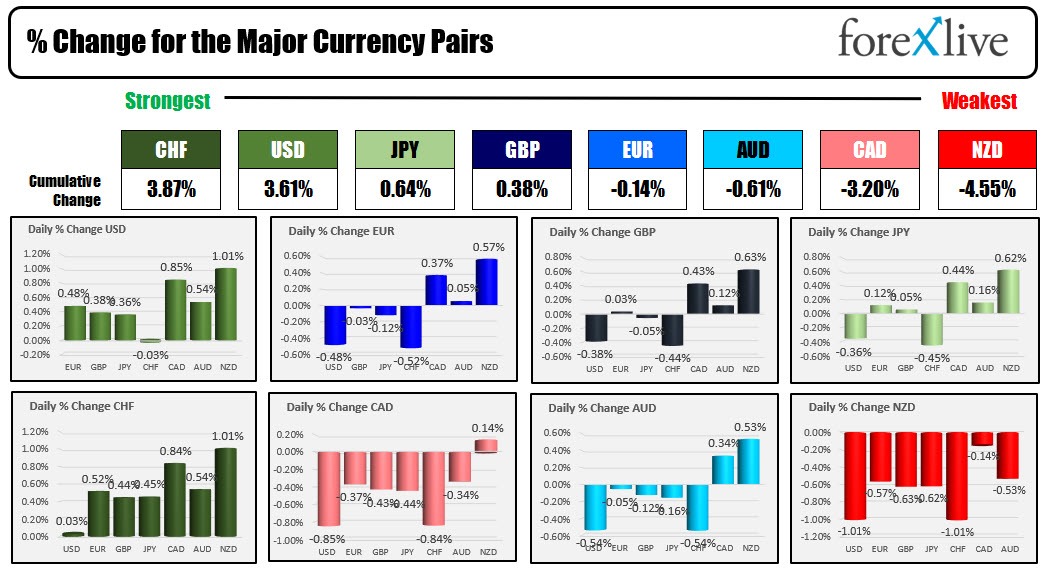

- The GBP is the strongest and the NZD is the weakest as the NA session begins

- ForexLive European FX news wrap: Dollar steadier as markets flip flop amid Fed focus

With one more sleep until the Fed rate decision tomorrow, the dollar moved higher, yields moved higher, stocks moved lower erasing the gains seen yesterday.

The Fed is expected to hike by 75 basis points to the target range of 3.0% to 3.25%. That would also put the Fed in restrictive policyThe focus will be on the dot plot and central tendencies. Where does the Fed see the terminal rate to be? Do they lok for a lower rate in 2023 or 2025

Looking at the strongest to the weakest of the major currencies, the CHF is nudging out the USD as the strongest of the major currencies. The NZD is the weakest. The greenback moved up 1.01% vs the NZD and 0.85% vs the CAD. The NZDUSD moved to the lowest level since April 2020. The USDCAD moved to the highest level since October 2020 and in the process moved above its 50% midpoint of the move down from the 2020 high at 1.3336. Stay above that level in the new trading will keep the buyers in firm control.

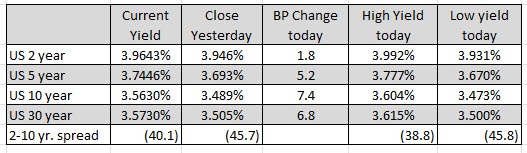

The bond yields moved higher with the 2 year up 1.8 basis points. The 10 year moved up 7.4 basis points. The 30 year moved up 6.8 basis points. Although higher, the 2 year moved to yet another 2002 high at 3.992%. The 10 year yield moved up to 3.604%.

In the US stock indices, the major indices closed lower with declines near 1% in the major indices.

On the economic front, the US housing starts moved higher in the August helped by lower interest rates in that month. However, the building permits fell as builders are deciding not to add to the backlog of orders this month.

In Canada, the inflation data came in weaker than expected.The data helped the keep the CAD weak on the day.

In other markets:

- Gold is lower following the dollar and the rates. The price is down -$11 or -0.66% at $1664.62

- Silver is down -$0.28 or -1.45% at $19.26

- Crude is -$0.77 at $84.23

- Bitcoin is trading down -$19000 at $18956.