- US major indices close solidly higher ahead of the CPI data tomorrow

- BOCs Macklem: interest rate hikes have begun to work, but will take time to feed through

- WTI crude oil futures settle at $73.17

- US November budget deficit $-249 billion versus $-248 billion estimate

- House financial services committee publishes prepared testimony from FTX CEO Ray

- Goldman Sachs is cutting hundreds more jobs

- US treasury auctioned off 32 billion of 10 year notes a high yield of 3.625%

- Most European major indices close lower on the day

- U.S. Treasury auctions of $40 billion of 3 year notes at a high yield of 4.093%

- US dollar moves higher into the London fixing

- New York Fed survey on inflation: Year ahead inflation falls to 5.2% from 5.9% last month

- WSJ Timiraos: How long should Powell keep raising rates?

- CNBC Survey: Expect 50 bps this week and another 75 BP next year

- IMF says total public and private debt fell to 247% of GDP in 2021

- The US treasury will auction off both 3 and 10 year notes today

- The weekend forex technical report

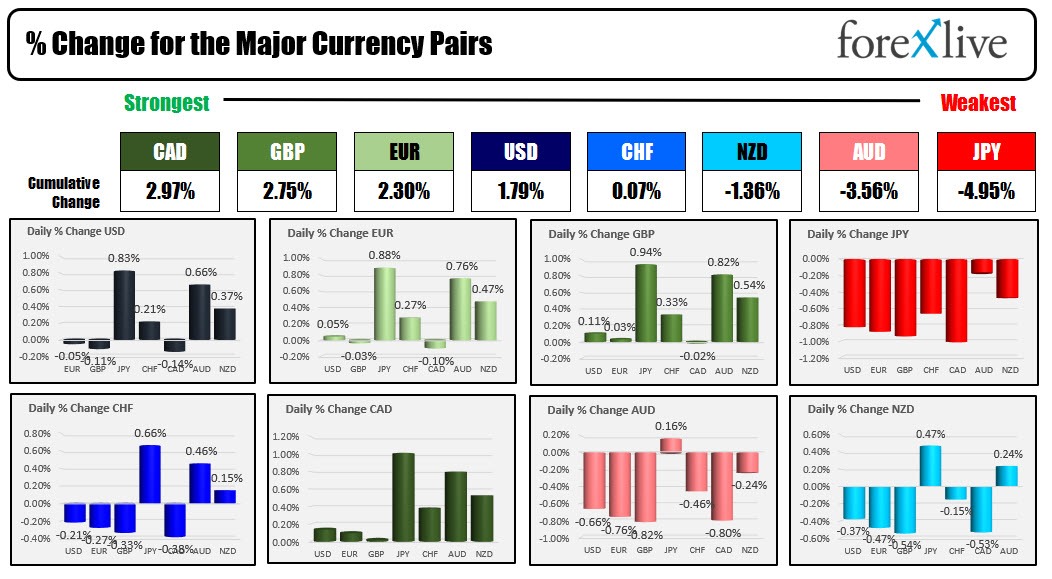

- The EUR is the strongest and the AUD is the weakest as the NA session begins

- ForexLive European FX news wrap: Tentative start to a momentous week

Markets:

- Gold fell $-16 or -0.89% at $1780.90

- Silver fell $0.16 or -0.67% at $23.28

- crude oil rose $2.38 to $73.41

- Bitcoin moved back above the $17,000 level at $17,196

In the US stock market, the major indices with higher open for lower inflation tomorrow:

- Dow Industrial Average was 528.57 or 1.58% at 34005.04

- S&P index rose 139.13 points or 1.26% at 11143.75

- NASDAQ index rose 139.13 points or 1.26% at 11143.75

In the forex market it was more the calm before the storm as the market awaits the CPI data. The CAD was the strongest of the majors, while the JPY was the weakest. The USD was mixed. The greenback is endind the day higher vs the JPY, AUD and NZD, and small declines vs the EUR, GBP, and CAD. The CHF was marginally higher after it first moved lower in the Europe morning session, before rebounding back higher from whence it came in the NY Session.

Tomorrow, the US CPI will give the Fed one last look at inflation ahead of their interest rate decision on Wednesday. The policy makers will start their meeting after the economic release, and although the expectations are that the number will not alter the "game plan" for the Fed of a 50 basis point hike that will officially "slow the pace" of the hikes (after 4 straight 75 basis point hikes), the markets could shift the terminal rate view if the inflation data is too hot or too cool. A larger increase will send the USD higher (and stocks lower, and yields higher). A smaller number, will send the USD lower (and stocks higher and yields lower).

Regardless, the slower pace will likely continue with even slower hikes as the policy becomes more restrictive. Next meeting could see a 25 basis point hike and that might continue over the next few meetings before reaching the terminal rate and the final phase. That will be when the Fed will "steady policy for an extended period of time".

Admittedly, it sounds too good to be true that the Fed will be able to land the economy on the launch pad - like a SpaceX rocket - but the Fed has their playbook and they will run the scripted "plays" as per that plan. However, they leave the door open to a higher or lower terminal rate, largely dependent on the inflation data in the US and then the jobs data.

For today we had a fairly calm day. Yes stocks moved higher perhaps in anticipation of that long-awaited week or inflation reading, but the USD had bouts of weakness here and there and bouts of strength here and there. So it is more in the wait and see mode to see what CPI brings us in the new trading day.

Good fortune with your trading