- Stocks rebound ahead of the Fed decision tomorrow.

- Sarah Bloom Raskin withdraws nomination for Fed

- WTI crude oil futures settle at $96.44

- CBOT Wheat futures higher and retest broken 100/200 hour MAs

- 'Peace' trades cool after Putin comment as the Fed countdown begins

- European indices close mixed on the day

- Putin: Ukraine is not serious in finding mutually-acceptable solution

- ECB's Lagarde: In all scenarios, inflation is still expected to decrease progressively

- What to expect from the FOMC on Wednesday - BofA

- Gold nears $1900 as the reversal continues

- Saudi Arabia considers accepting yuan for oil sales. OPEC leaves demand forecast unchanged

- Canadian home prices rose another 3.5% in February - CREA

- Empire Fed manufacturing index for March -11.8 versus 7.0 estimate

- US February PPI +10.0% vs +10.0% y/y expected

- Canadian January manufacturing sales +0.6% vs +1.3% expected

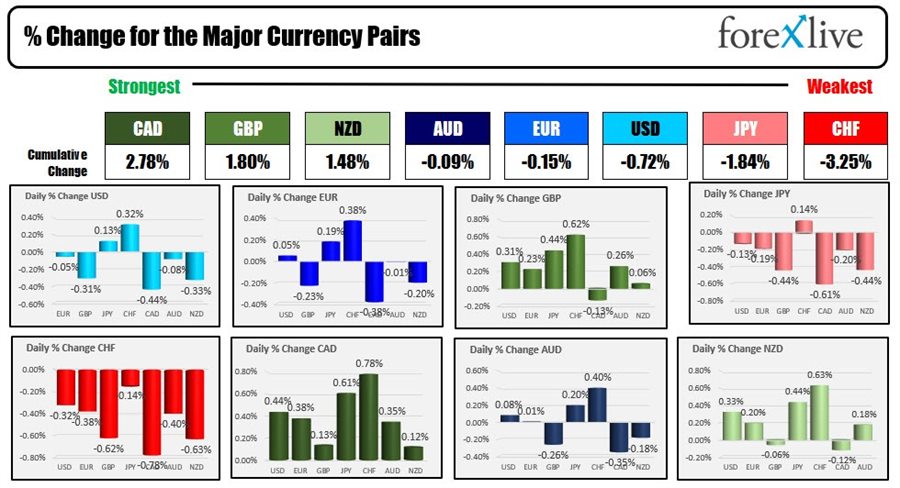

- The GBP is the strongest and the CHF is the weakest as the NA session begins

- ForexLive European FX news wrap: Oil tumbles, markets more mixed

The markets today were able to absorb a 10% YoY rise in the PPI inflation gauge. The month-to-month was a bit lower than expectations but producer prices most likely have another decent gain next month.

Nevertheless, hope springs eternal, that the YoY gains will start to come back down. One positive is some hefty month on month rises seen over the last year will begin to exit the YoY calculation. In 3 of the next 5 months a 1.0% MoM gain will drop out of the YoY calculation. The other 2 months had gains of 0.6% and 0.8%. So roughly 4.4% of gains will hopefully be replaced with something lower, which will bring PPI YoY levels down from here. That is the hope at least.

The other piece of data out of the US was the Empire manufacturing index which moved negative for the first time since May 2020 near the start of the pandemic. The index is more timely in that it is from a more current survey of businesses. As a result, it can gauge the impact from the most recent geopolitical events. Other regional indices will be coming out soon including a Philly Fed manufacturing index on Thursday. The Richmond Fed index will be released next week.

If there is a bright spot from all the geopolitical issues that are impacting not only prices but growth, it is that the Fed might once again be a little more reluctant to slam on the brakes.

The FOMC will announce their rate decision tomorrow at 2 PM ET. The expectations are for a 25 basis point hike despite the recent economic and geopolitical developments. The market will be focused on the Fed's central tendencies projections for GDP, inflation, and employment, and also the so-called dot plot of rate expectations. In December, the FOMC forecast three hikes in 2022. That is likely to move up to 4 to 5 hikes.

Today, the stock market took the data in stride. It was marginally higher at the open and continued to move higher throughout the day, with closing levels near the highs for the day. The gains were led by the NASDAQ index which rose by nearly 3% (2.92%). The broad S&P index also advanced nicely with a 2.14% rise.

Gold prices continued its move back to the downside after trading as high as $2070 last week. Today, the price traded as low as $1907.14. It is trading near $1916.89 down $33.11 or -1.7% near 5 PM New York.

Crude oil was also sharply lower today. The price is trading around $95 which is down around eight dollars or -7.81%. Like gold, it wasn't long ago that the price was trading at $130. The $35 decline represents a near 27% fall from the high, but is still up some 52% from the early December low price. An outbreak of Covid in China and the subsequent lockdown of major cities is having traders will think the demand side of the equation while supply still remains a wildcard due to Russia/Ukraine. Word with regard to Iran continues to be more positive of a nuclear deal which should open up Iranian oil to the market. Will the decline be reflective in the price at the pump and help to bring inflation back down in subsequent months?

In the forex market, the CAD is ending the day is the strongest of the majors while the CHF is the weakest. The USD is mixed to lower with gains verse the JPY and CHF and declines vs the GBP, CAD and NZD. The greenback was little changed versus the EUR and the AUD today.

Technically speaking:

- GBPUSD: The GBPUSD found support buyers at the 1.300 level in the Asian session and moved higher into the North American session. However resistance against the falling 100 hour moving average and a swing area up to 1.30878, put a lid on the rally and the price rotated lower into the close. The current price is trading at 1.3038 which is nearer the midpoint of the 1.3000 level below, and the 1.30878 level above. Both those levels will be hide in the new trading day for a break. The trend has been to the downside, so a break above the 100 hour moving average and top of the swing area 1.30878 would still have to contend with the falling 200 hour moving average at 1.3132. The price has not traded above the 200 hour moving average since February 23.

- EURUSD: The EURUSD had a up and down trading day. The move to the upside was able to break back above the 200 hour moving average and 100 hour moving average on its way to a high price of 1.10196. However, in the New York afternoon session the price rotated back below those moving average levels and is closing below the 200 hour moving average at 1.09576. If the sellers are to remain in control, staying below the 200 hour moving average and the higher 100 hour moving average at 1.09819 would be required. On the downside moving below the 1.0900 level would open up the door for further downside momentum.