- Marginally higher closes for the major US stock indices in a ho-hum session

- WTI crude oil futures settle at $90.50

- More from Kashkari: Forward guidance on Balance sheet helped push yields higher

- Fed's Kashkari: Are getting some help on inflation from the supply side.

- Fed's Bullard: Favors a 75 basis point hike in September

- Fed's George: Inflation number last month is encouraging but not time for a victory lap

- New lows in the GBPUSD as London traders look to exit

- European major indices close mostly higher

- Next week the US treasury will sell 2, 5, and 7 year notes. US yields are lower today.

- OPEC Secretary-General: Relatively optimistic on oil outlook for 2023

- US leading index for July -0.4% vs -0.5% estimate

- US existing home sales 4.81M vs 4.89M estimate

- Fed's Daly: Core services inflation is still rising

- Philadelphia Fed business index 6.2 vs -5.0 estimate

- US initial claims for the current week 250K vs 265K estimate

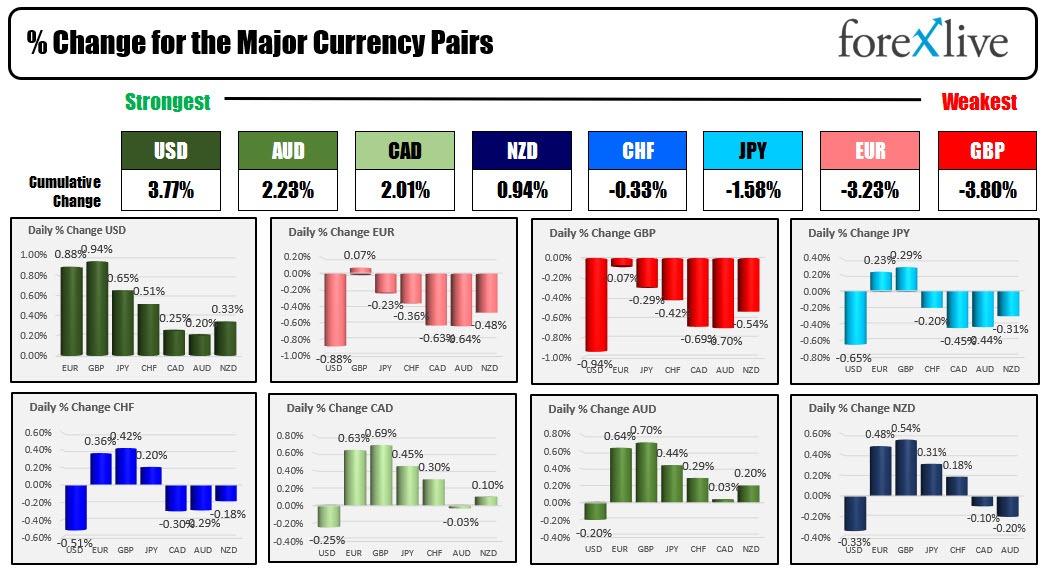

- The AUD is the strongest and the CHF is the weakest as the NA session begins

- ForexLive European FX news wrap: Mixed moves as markets lack poise

Last week, the EURUSD broke outside an up and down trading range for about 2 trading days before heading back into the range on Friday. Today, the EURUSD broke outside the lower swing area between 1.0096 and 1.0121. The break increases the bearish bias for the pair. The question into the new trading day is "Can the price stay below 1.0121?". If it can the sellers can continue the downside probe that saw the July low reache 0.99515.

The GBPUSD was also caught in that selling (buy dollar) feeling. IT fell to the lowest level since July 22, and in the process fell below its recent floor area that was defined from July 26, July 27, August 5, and August 15 lows between 1.2002 and 1.20192. The 50% midpoint of the range since the July 14 low was also broken today at 1.2026. The low price today reached into a lower swing area between 1.1957 1.19248. Getting below that level in the new trading day will open up the door for further downside momentum. It's July low reached 1.17594. There is plenty of room to roam on further downside momentum. Conservative risk now is up near the 1.2019 and the 1.2026 levels (but you can also argue that the 1.200 natural level should also be a bias defining barometer).

The USDJPY made its break above a ceiling area between 135.29 and 135.575. The high price extended up to its 61.8% retracement of the move down from the July 14 high. That level comes in at 135.945. If traders get above that level in the new trading day, I would open up the upside even more with 137.00 as the next upside target area. Close risk is down to the 135.29 level.

Overall the forex market today the USD was the strongest of the majors, while the GBP, EUR and the JPY were the weakest.

A look at other markets in the US as the session comes to a close shows:

- spot gold is down -$2.6 or -0.15% at $1758.96

- Spot silver is down -$0.22 or -1.15% at $19.53

- Crude oil is up $2.40 at $90.51

- Bitcoin is trading at $23400, up marginally on the day.

In the US stock market, the major indices had modest gains. The Dow industrial average is going into the final trading day with a 0.7% gain for the week. The S&P index is near unchanged while the NASDAQ index is marginally lower. All 3 indices are working on for week winning streaks. For today:

- Dow industrial average rose 18.72 points or 0.06% at 33999.05

- S&P index rose 9.7 points or 0.23% at 4283.73

- NASDAQ index rose 27.23 points or 0.21% at 12965.35