- Tech stocks rebound from the lows to leave US equities largely unchanged

- How Goldman Sachs sees the US economy right now

- WTI crude oil futures settle at $78.76

- Video: Dollar dominance and the dance of global economies: What lies ahead?

- JPY: The devil in the BOJ details - Barclays

- Bitcoin staying below its 100 hour moving average. Bearish bias in the short term.

- ECBs Makhlouf: It is too early to plan for a pause in our tightening of policy

- ECB's Villeroy on rate hikes: We have travelled most of the journey

- ECB's Schnabel: 50 basis points are not off the table

- Nasdaq under pressure as Tesla shares fall to the lowest since January

- Dallas Fed manufacturing PMI -23.4 vs -15.7 prior

- US March retail sales revised to -0.6% from -1.0%

- Belgian April business confidence -7.8 vs -7.6 prior

- Canada March new housing price index 0.0% m/m vs -0.2% prior

- Chicago Fed March national activity index -0.19 vs -0.19 prior

- The CHF is the strongest and the JPY is the weakest as the NA session begins

- Bitcoin to $100,000? Possible by end of 2024, says Standard Chartered

- ForexLive European FX news wrap: Mixed dollar amid mixed markets

The USD moved lower today, only surpassed by the declines in the JPY. The EUR meanwhile was the strongest of the currencies.

The USDs decline was helped by falling rates. Looking at the US debt market, yields moved down about 6-8 basis points on the day. More specifically:

- 2 year yield 4.126%, -6.3 basis points

- 5 year yield 3.588% -7.7 basis points

- 10 year yield 3.501% -7.1 basis points

- 30 year yield 3.718% 16.0 basis points

The Dallas Fed manufacturing index for April was weaker than expectations That -23.4 versus -15.7 last month. The data was the only economic data out today, but helped to build the bias lower for rates and the US dollar.

Meanwhile in US equity markets, US stocks traded on both sides of unchanged an up-and-down session. The NASDAQ index is closing on the negative side. The S&P index and the Dow Jones industrial average closed in positive territory:

- Dow Industrial Average rose 66.44 points or 0.20% at 33875.41. The index felt -82.88 points at its lows before rebounding

- S&P index rose 3.52 points or 0.09% at 4137.03. The S&P index traded down -15.74 points

- NASDAQ index fell -35.26 points or -0.29% at 12037.19. The NASDAQ index reached a low of -112.15 points intraday

This week there will be a number of key earnings announcements including Alphabet, Meta, Amazon, Microsoft, Boeing, Intel and Caterpillar (among others). Tomorrow's key releases include:

- Microsoft

- Alphabet

- 3M

- GM

- UPS

- McDonald's

As mentioned the US dollar moved lower in trading today held by the lower US interest rate. Looking at some of the major currency pairs from a technical perspective:

- The EURUSD began the US trading session close to the lower boundary of a swing area near 1.1000. This level successfully held as support, and the pair subsequently climbed to a high of 1.10495. At present, the price is trading around 1.1045. The next key upside targets are the swing highs from last Thursday and Friday, which are 1.10669 and 1.10753, respectively. The pair found support at its rising 100-hour moving average, and maintaining this level would provide buyers with the confidence to continue pushing the price upward.

- The EURUSD began the US trading session close to the lower boundary of a swing area near 1.1000. This level successfully held as support, and the pair subsequently climbed to a high of 1.10495. At present, the price is trading around 1.1045. The next key upside targets are the swing highs from last Thursday and Friday, which are 1.10669 and 1.10753, respectively. The pair found support at its rising 100-hour moving average, and maintaining this level would provide buyers with the confidence to continue pushing the price upward.

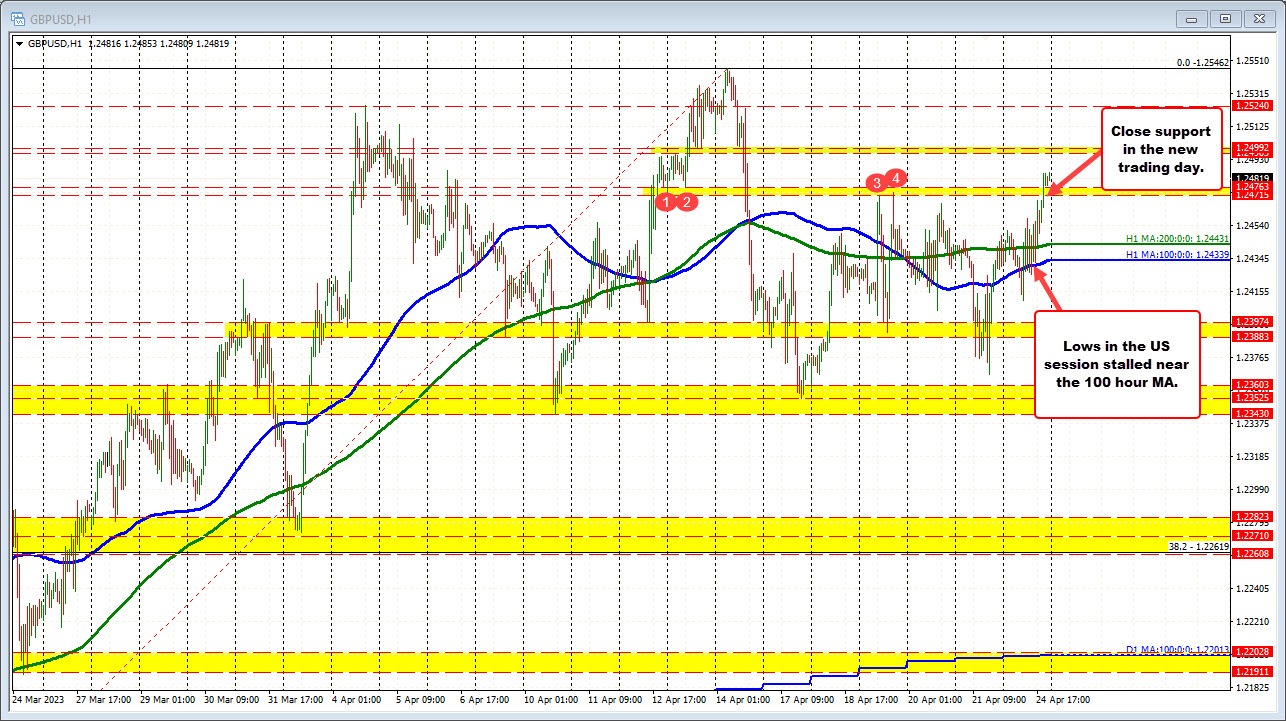

- The GBPUSD experienced an upward trend during the US trading session, surpassing a key resistance zone ranging from 1.2471 to 1.24763. The pair's highest value reached 1.24853, with the current price hovering slightly below at 1.2482. As the new trading day begins, immediate support can be found at the 1.2471 level. The next target for the currency pair lies within the range of 1.2495 to 1.2499, which corresponds to the swing highs and lows observed between April 12th and 14th.

- The USDCAD experienced limited fluctuations, with trading confined to a narrow range between 1.35218 and 1.35688. During the late Asian-Pacific session, the highest price surpassed the upper swing area at 1.35638, but it quickly reversed course. The pair's move lower touched and briefly broke the 100-day moving average of 1.35267 twice, but could not maintain a position below this level. The current price of 1.3538 lies between these support/resistance levels. As the new trading day commences, market participants will be watching for a decisive break either below the 100-day moving average at 1.35267 or above the upper swing area at 1.35638. Until then the pair remains contained between the technical levels.

In other markets,

- The fall in the USD and rates, helped to support gold prices which is trading up $6.33 or 0.32% at $1988.93

- Spot silver is up $0.06 or 0.23% payout $25.14

- Crude oil rose $0.80 or 1.03% at $78.67

- Bitcoin moved lower and trades at $27,443. The low price reach $26,981 the 1st time below the $27 level since March 28.