- US major indices snap two day winning streak

- Are you ready for the Australian jobs report? Watch this video and you will be...

- Feds Bullard: Rate hikes have had an impact especially in the housing market

- Times reporter Swinford: The bell is tolling from PM Truss

- The Sun: TORY CHIEF WHIP GONE

- Fed's beige book for October is released. A little good/a little not so good is the theme.

- Pres. Biden: Gas prices are squeezing family budgets. US to sell 15M barrels from SPR

- Fed's Kashkari: Sees little evidence a labor market softening

- US treasury auctions off $12 billion a 20 year bonds at a high yield of 4.395%

- Atlanta Fed GDPNow Q3 growth estimate rises to 2.9% from 2.8% last

- Interior minister Braverman tenders her resignation

- Major European indices close the session lower.

- UK Suella Braverman has departed as Home Secretary

- BOE Cunliffe: Big LDI funds have got to point where on avg. they could absorb 200BP hike

- EIA weekly crude oil inventories -1.725M vs expectations of a build of 1.380M

- Ukraine Zelenskyy:We are working to create mobile power points for critical infrastructure

- The morning forex technical report for October 19, 2022

- Canada September CPI 6.9% YoY vs. 6.8% estimate

- US building permits for September 1.564 million vs. 1.530 million estimate

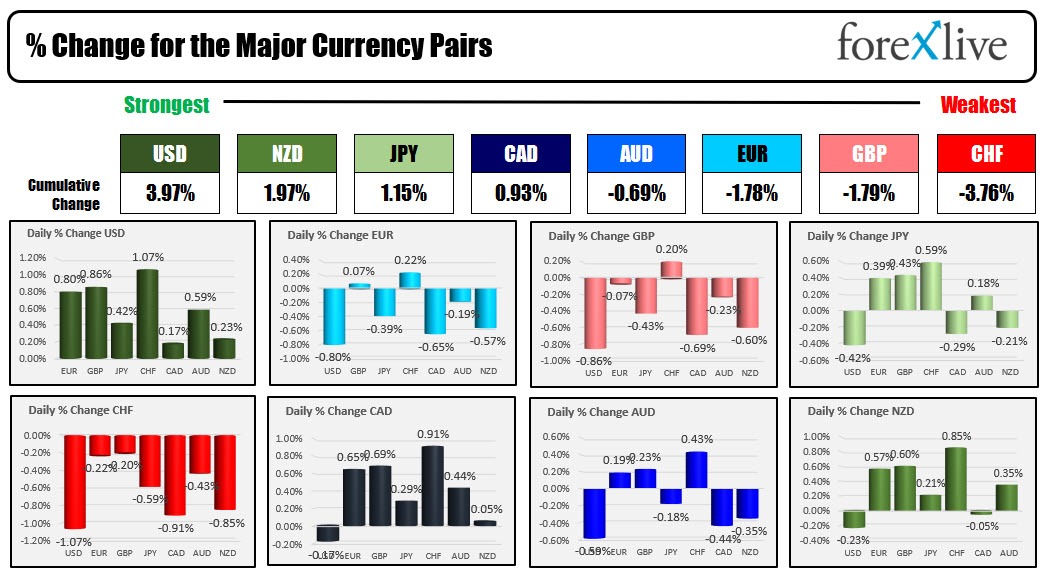

- The USD is the strongest and the CHF is the weakest as the NA session begins

- ForexLive European FX news wrap: Dollar back in favour, stocks and bonds fall

- UK PM Truss: I am a fighter, not a quitter

The US rates moved sharply higher in trading today pushed even more on the back of a clunker of a 20 year auction. The last six 20 year auctions had come in with a negative -1.3 bp tail to the WI level at the time of the auction. Today, the yield was 2.5 basis points above the WI level. International demand was weak. The bid to cover was lower much lower than the average. The dealers were saddled with a higher percentage. This was from the part of the yield curve that has a kink to the upside (the 10 year yield and the 30 year yield are near idential at 4.13% while the 20 year yield is up at 4.4%.

Looking at the yield curve:

- 2 year rose 12.4 basis points to 4.562% and traded to the highest level this year at 4.565% and the highest level since 2007

- 10 year rose to 14.5 basis points to 4.137% and traded to its highest level this year and going back to 2008

The higher rates, helped to propel the greenback. The USD is the strongest of the major currencies today. The CHF is the weakest (see video here). For the USDCHF it moved up to test the swing highs from May and June between 1.0043 and 1.00637. The high price reached 1.00624 before backing off into the close.

The EURUSD moved down -0.80% on the day in the end of day snapshot. It fell below its 100 hour MA in the last London morning session and stayed below that MA (at 0.9795 currently) for the most of the NY session (there was a brief move above that failed quickly) . The low moved down to 0.97565 which was just above the 200 hour MA at 0.97544 (see post here). The price did bounce modestly off the key 200 hour MA level and trades at 0.9772 into the close. The 100 and 200 hour MAs will be the risk and bias defining levels (on the topside for the 100 hour MA and the down side for the 200 hour MA) in the new trading day.

The GBPUSD was in synch with the EURUSD. Like the EURUSD, the GBPUSD fell below the 100 hour MA (more in the late Asian/early London session) and spent the rest of the day stepping down to the 200 hour MA at 1.11825. Buyers buyers stalled the fall (just like the EURUSD) at the risk defining MA level (the low reached 1.1184). The price bounced modestly into the close to 1.1216 but for astute traders against the key MA, that trade was worth 30-40 pips with little in the way of risk. The 100 hour MA at 1.12918 is top resistance. The 200 hour MA is downside support at 1.1182 going into the new trading day.

The USDJPY moved higher for the 11th consecutive trading day and inched closer to the natural key resistance level at 150.00. The price of the USDJPY has not traded to 150.000 since the week of August 1, 1990.

USDCAD is trading above and below the 100/200 hour MA (near converged) and awaits the next shove.

The AUDUSD has a modest tilt to the downside ahead of the Australia's employment report in the new trading day. To prepare for the key economic release check out the video below. I go through the bias, risk, targets (you remember that from THIS VIDEO from over the weekend).