- Major indices close higher with the NASDAQ index leading the way

- ECB's Knot: ECB should act in the face of high inflation

- Crude oil futures settle at $103.28

- Watch live: Biden speaks about supply chains

- Today's survey adds to the case for BOC to hike by 50 bps - RBC

- Russia's Lavrov: Too soon to say how increased realism from Ukraine might turn into a deal

- Talk of a global oil stockpile release is weighing on crude

- European indices end the session higher on the day

- AUDUSD takes off. Trades to highest level since July 2021

- Commodity currencies pop as tech stocks boost risk appetite

- Bank of Canada business outlook survey shows continued strength in business investment

- BOE's Cunliffe: Not convinced we have to lean heavily against inflationary mindset

- US February factory orders -0.5% vs -0.5% expected

- ECB's Vasle: The ECB's 2022 baseline inflation scenario is realistic

- German Finance Minister: Ending gas imports from Russia would hurt EU more

- Canada February building permits +21.0 m/m vs -8.8% prior

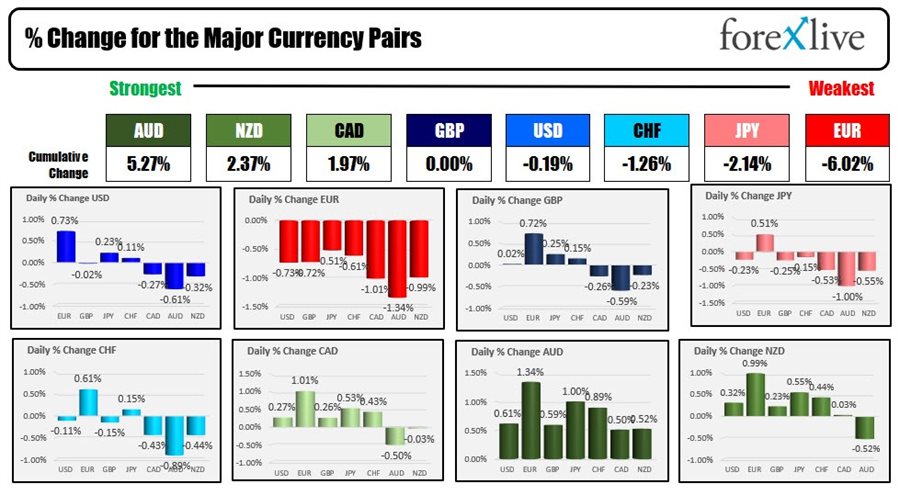

- The AUD is the strongest and the EUR is the weakest to start the trading week

- ForexLive European FX news wrap: Euro eases to start the week

The NASDAQ index saw a move of nearly 2% higher in trading today and that helped to kick start the commodity/risk on currencies to the upside. The gains in the forex were led by the AUD which rewarded the patient longs who had to withstand 9+ days of sideways price action within a narrow 90 pip trading range over those 9+ trading days.

Today, the AUDUSD traded in a 73 pip trading range for a single day and in the process broke above the ceiling area between 0.7535 and 0.7539. The high price extended to 0.7556 before settling into the close (trading at 0.7545 currently). Moreover, the swing area has been able to hold support and stay above keeping the break intact and the buyers in control. In the new trading day, the AUDUSD traders will be eyeing the 0.7535 level for close support. Staying above 0.7535, after the break today, is what longs are looking for, with a break back below likely to be a big disappointment (that leads to buyers turning to sellers).

For the NZDUSD it broke back above it's 100/200 hour MAs which are near converged at 0.6943. The high reached 0.6967 before rotating back down to retest the MAs near the close. IN the new trading day, staying above those MAs will be a key barometer for the buyers and sellers. Stay above and the buyers remain in control. Move below, and the sellers are more in control.

The USDCAD has also made a break lower and trades below it's falling 100 hour MA at 1.2497. Stay below is more bearish. Move above and then above it's 200 hour MA at 1.25118 would hurt the bearish bias. The price on Friday and again in the Asian session today, tried to move above the 200 hour MA only to fail on the breaks. A move above for the 3rd time might "be the charm" and lead to more upside corrective momentum. Absent those breaks with momentum, however, and the sellers remain in control.

The EUR was the weakest of the majors today and the EURUSD saw consistent selling in the day. The move lower was kickstarted by breaking below it's 200 hour MA near 1.1039 and continued down through the 50% midpoint of the move up from the March 7 low at 1.09946. The low did stall in a swing area between 1.0957 and 1.0967. The current price is just above the high of that swing area at 1.0972. IN the new day sellers would want to see that swing area broken. A move back above the 50% midpoint at 1.0004 would be a disappointment.

In other markets today:

- The price of gold was marginally higher by $8.44 at $1932.74. The low price at $1915 was comfortably above the $1900 level

- Crude oil moved higher as rhetoric on Russian atrocities over the weekend, has Putin back on the defensive, Ukraine and NATO members talking of more sanctions and that combination delays peace talks and increases the potential for reduced oil from Russia. The price of crude is trading at $103.71 up $4.44 or 4.47%

- bitcoin is trading at $46,387. The low price reached $45,124 while the high price was at $46,457

In the US stock market as mentioned, the NASDAQ led the way with a near 2% gain. The final numbers are showing:

- Dow industrial average up 103.61 points or 0.3% at 34921.89

- S&P index up 36.76 points or 0.81% at 4582.63

- NASDAQ index up 271.06 points or 1.9% at 14532.56

- Russell 2000 rose 4.32 points or 0.21% at 2095.44

In the US debt market, the 2– 10 year spread did widen a bit but remained negative by about 2.1 basis points

- two year yield 2.422%, -0.2 basis points

- 10 year yield 2.401%, +0.4 basis points

- 30 year yield 2.458%, unchanged on the day