Federal Reserve

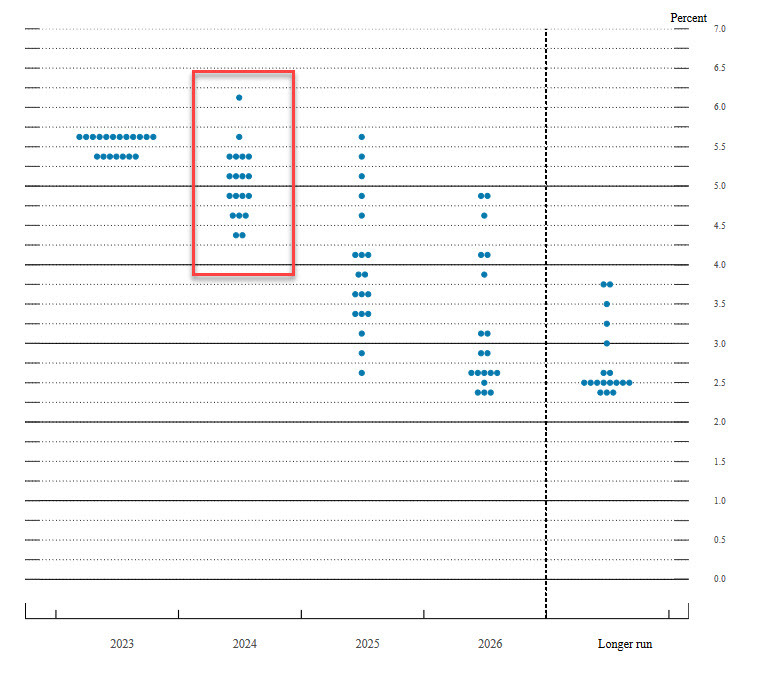

The headline is the median dot falling further than expected, putting a full 50 bps of easing into the curve rather than the 25 bps expected. In addition, there are five dots below that.

- Fed funds rate left unchanged at 5.25-5.50%, as expected

- Recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter

- Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low

- Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain

- Fed refers to " the extent of any additional policy firming that may be appropriate" vs the extent of additional policy firming that may be appropriate"

There has been a straightforward dovish reaction to this statement with the US dollar falling, Treasury yields dropping and US equities bid.

Dot plot:

- Dec 2024 median dot vs 5.1% prior

- Dec 2025 median dot vs 3.9% prior

- Dec 2026 median dot vs 2.9% prior

- Longer run Fed funds projection vs 2.5% prior

Growth projections

- 2023 GDP 2.6% vs 2.1% prior

- 2024 GDP 1.4% vs 1.5% prior

- 2025 GDP 1.8% vs 1.8% prior

Unemployment projections:

- 2023 unemployment 3.8% vs 3.8% prior

- 2024 unemployment 4.1% vs 4.1% prior

- 2025 unemployment 4.1% vs 4.1% prior

Inflation:

- 2023 PCE inflation 2.8% vs 3.3% prior

- 2024 PCE inflation 2.4% vs 2.5% prior

- 2025 PCE inflation 2.1% vs 2.2% prior

Core inflation:

- 2023 PCE core inflation 3.2% vs 3.7% prior

- 2024 PCE core inflation 2.4% vs 2.6% prior

- 2025 PCE core inflation 2.2% vs 2.3% prior

The previous economic projections were made at the Sept 20 FOMC meeting.

Fed dot plot from the Sept 20 meeting