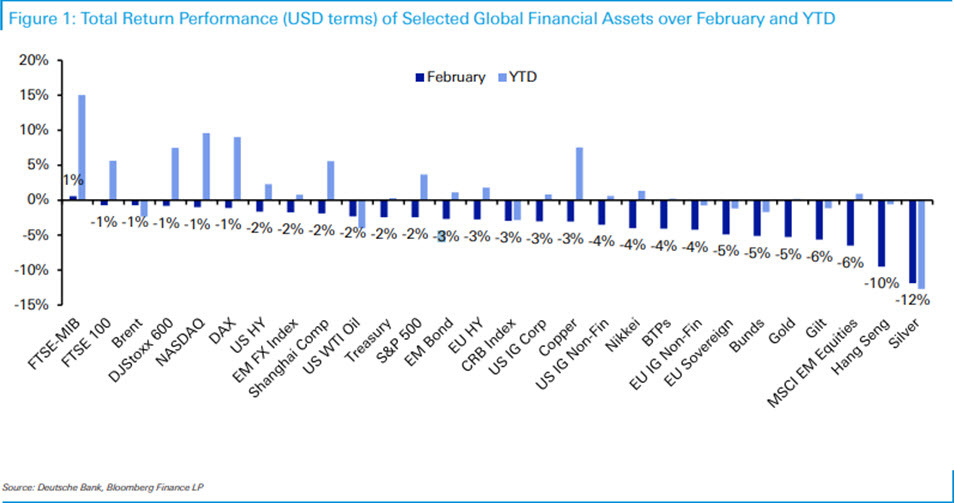

A chart today from Deutsche Bank is a reminder that February trading as all about economic data as a series of strong releases led to a repricing of the path of US interest rates to a higher plateau. In turn, risk assets slid and the US dollar was only bested by a single major global market (and by only 1%).

What I would note is that on most fronts, the declines weren't particularly rough and that may speak to a cushion from better global growth. There might be inflation but the market isn't (yet?) worried about stagflation.

Looking ahead, Deutsche Bank asks: "So for March, the big question for markets is whether this terminal rate repricing has further to run, or whether this is as hawkish as it gets?"