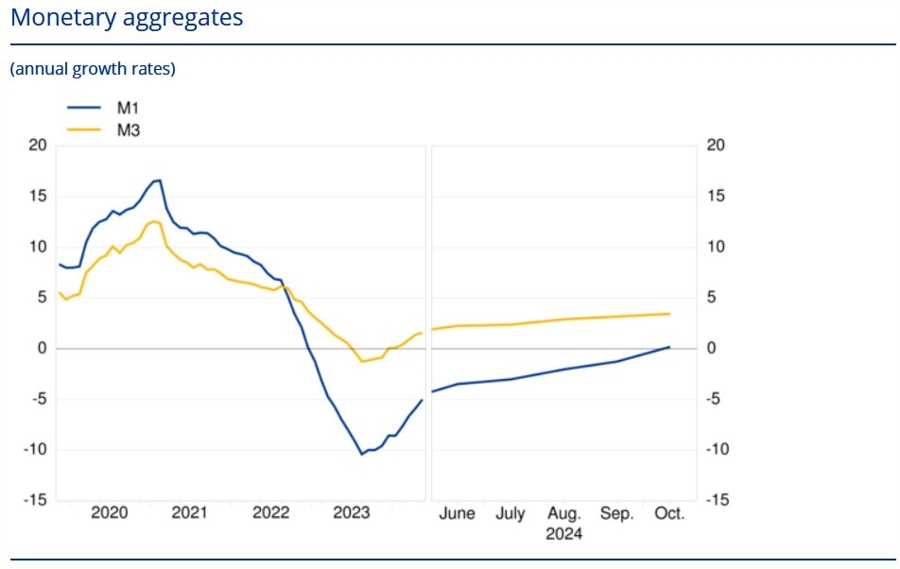

- M3 Money Supply Y/Y 3.4% vs. 3.4% expected and 3.2% prior.

- Loans to Households Y/Y 0.8% vs. 0.8% expected and 0.7% prior.

- Loans to Companies Y/Y 1.2% vs. 1.1% prior.

Most Popular

Sponsored

NVDA shows rare quant signal; 10-wk return $170-$198. Bull call spread targets $190 for 170% payout.

Billionaires ditch US assets for Europe & China! Tariffs & conflict loom. Private equity favored.

AppLovin (APP) stock soars 110% on AI, margins hit 82%! Analysts see 25% upside with a $775 target.

Big Tech's 300% surge faces valuation scrutiny; traders eye healthcare, industrials, energy for 2026.

AI boom fuels PC price surge! RAM costs jump, Dell hikes prices. Traders eye value amid rising costs.

UK economy contracts 0.1% in Oct! Traders eye BoE rate cuts as growth stalls. Where's the jump-start?

Dividend ETFs like JEPI & SPHD outpace S&P 500! Retirees eye high yields, but AI era shifts strategy. Watch valuation!

Sponsored

Must Read