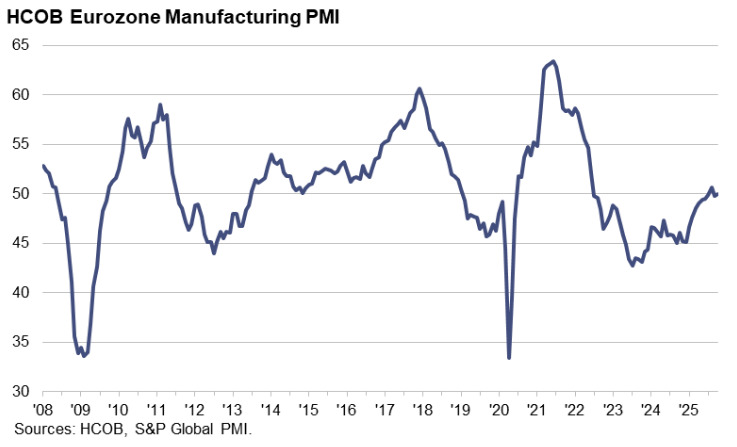

- Prior was 49.8

- Full report here

Key findings:

- New orders flatline and employment falls in October, but output creeps higher

Comment:

Commenting on the PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“In the eurozone’s manufacturing sector, we can at best speak of a very delicate sprout of economic recovery. Output has risen for eight consecutive months, but there is no real momentum as it is increasing at pretty much the same modest pace as in the previous months. Meanwhile, demand across the eurozone economy remained subdued, with new orders stagnating at the same level as the month before.

“Job cuts continued and even picked up a bit. This is the result of weak demand, which is forcing companies to cut costs or boost productivity. Supply chain uncertainties, especially around basic semiconductors, may have contributed to longer delivery times and could weigh on production in sectors like automotive and mechanical engineering. For this reason alone, many companies are unlikely to be in any rush to hire more staff in the short term.

“The state of the eurozone’s manufacturing sector can be summed up as fragile in Germany, in recession in France, persistently weak in Italy, and showing only subdued growth in Spain. The politically tense situation in France is clearly not only contributing to the renewed slump in production there, but is also reflected in a sharp drop in the index for future output. France is significantly dampening demand for industrial goods across other eurozone countries, where it ranks among the top trading partners.

“The inventory cycle still shows no signs of a turnaround. Companies continue to reduce stock levels, both in terms of intermediate goods and finished products. In the short term, this may also be linked to the issues with semiconductor deliveries. But the more important reason for the inventory drawdown is likely the simple fact that demand in the industrial sector remains weak.”