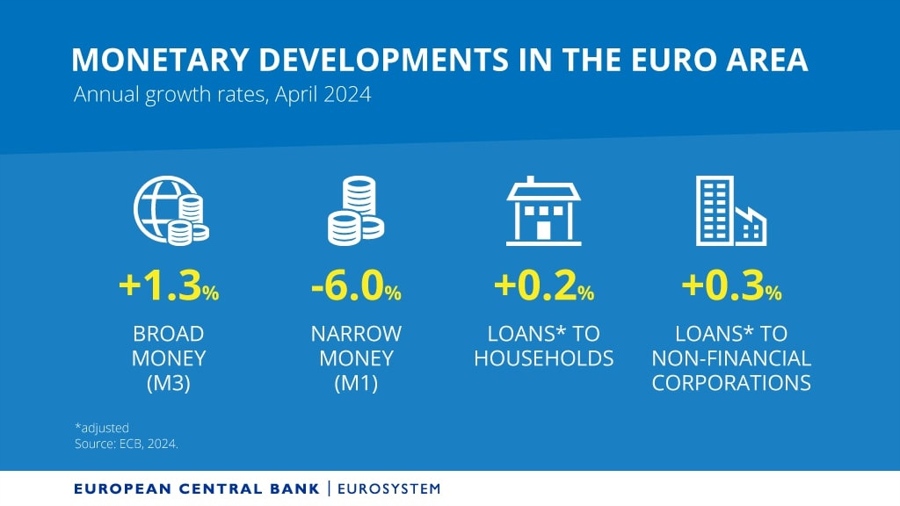

- Money Supply M3 Y/Y 1.3% vs. 1.3% expected and 0.9% prior.

- Loans to Households Y/Y 0.2% vs. 0.4% expected and 0.2% prior.

- Loans to Companies Y/Y 0.3% vs. 0.4% prior.

Click here for the full report.

Click here for the full report.

Most Popular

Japan's bonds tumble, 10-yr yield hits 27-yr high. Fitch affirms 'A' rating, sees manageable deficits despite election tax cut pledges.

S&P 500 beats earnings 81% of the time, but shares lag! Valuations at 22x forward earnings, high risk.

Gold hits $4,800, up 2.2% amid trade war fears. US futures rise, EU stocks mixed. Watch Trump's Davos speech!

Bitcoin stabilizes near $90K, altcoins pare losses after macro selloff. Gold hits record highs, crypto finds breathing room.

Gold & Silver spreads widen 300-500% on physical scarcity & higher capital costs; traders watch volatility.

Trump's family fortune surges $6.8B, with crypto ties growing. Unprecedented presidential profits raise conflict of interest flags.

UK inflation hits 3.4%, beating forecasts! Cost of living pressures mount as traders eye BoE rate moves.

Must Read