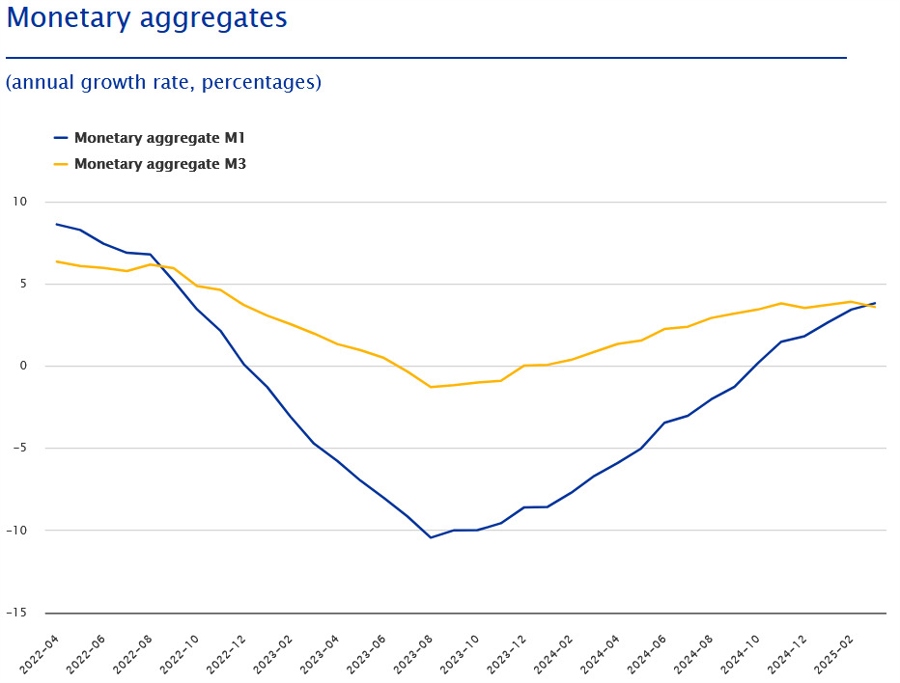

- Eurozone March M3 money supply +3.6% vs +4.0% y/y expected

- Prior +4.0%

- Loans to households Y/Y 1.7% vs 1.5% prior

- Loans to companies Y/Y 2.3% vs 2.2% prior

Most Popular

Sponsored

S&P 500 hits record high on Fed cut & growth optimism. Muted sentiment signals more upside, not a bubble.

HELOC rates dip below 7.5% post-Fed cut; Fifth Third offers 4.99% intro. Homeowners tap equity, watch variable rates.

China eyes $70B chip subsidy package, boosting domestic firms like SMIC & Moore Threads (up 600%+). Geopolitical tech war heats up.

Oracle stock plunges on AI bet fears; traders eye Nvidia's slide & valuation concerns.

India Inflation Rate Y/Y 0.7% vs 0.7% expected (0.25% prior)

MSTR shares down 65% from peak; Nasdaq 100 removal looms. Bitcoin holdings > market cap. Valuation questioned.

BAND's 0.6x P/S valuation hides weak margins; FDX's 15.1x P/E faces flat sales; JAZZ's 7.4x P/E shows EPS decline.

Sponsored

Must Read