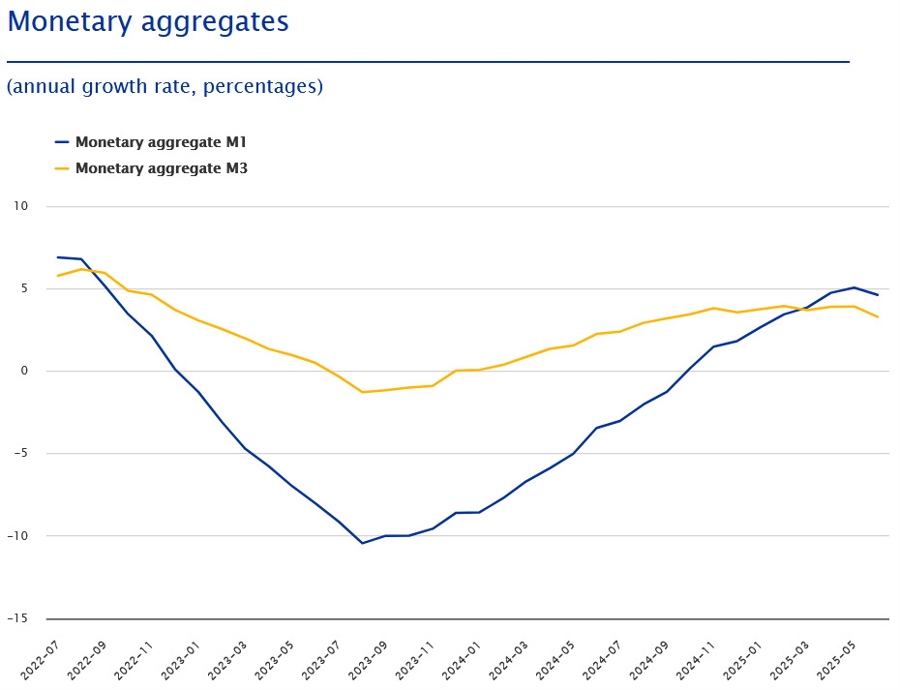

- Prior +3.9%

- Loans to households Y/Y +2.2% vs +2.0% prior

- Loans to companies Y/Y +2.7% vs +2.5% prior

This is not a market moving release. The money supply growth was expected given the ECB easing.

This is not a market moving release. The money supply growth was expected given the ECB easing.

Most Popular

January barometer's asterisk: Gold's wild ride, stocks rally, bonds quiet. Traders eye the unusual market signals.

Gold's $8.5k long-term target eyed as futures oversold; silver flips overbought. Traders eye ETFs & stocks.

Judge denies MN's request to halt ICE surge; 3k agents remain. Legal battle over federal power continues.

NEM options show hedged bullishness; RIVN calls offer 113% upside potential. TEVA's 121% gain faces smart money selling.

XRP dumped 6.7% on $70M liquidations, breaking $1.79 support. Buyers eye $1.74, but bulls need $1.79 reclaim.

Bitcoin dips 6.53% to $78,719 amid Fed chair uncertainty. Traders eye support levels after November lows.

UUUU surges 14% on nuclear initiative; rare earth projects boast $1.9B NPV & 33% IRR. Analysts see $22.68 target.

Must Read