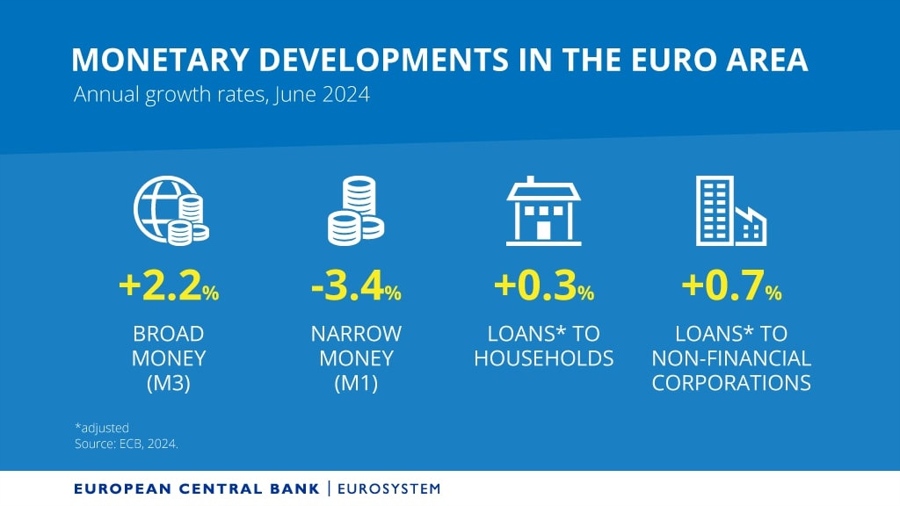

- M3 Money Supply Y/Y 2.2% vs. 1.8% expected and 1.6% prior.

- Loans to Households Y/Y 0.3% vs. 0.5% expected and 0.3% prior.

- Loans to Companies Y/Y 0.7% vs. 0.3% prior.

Most Popular

Japan bond yields spike, dragging BTC down 3.3% to $89.3K; Gold hits record $4866. Global liquidity tightens.

Gold hits $4,800 as Trump's tariff threats spook Asian markets; Nikkei down 0.7%, US futures rise.

Greenland's vast oil & mineral potential faces high extraction costs & infrastructure hurdles. Analysts doubt feasibility despite US interest.

Dow, S&P 500 hit by tariff threats, worst day since Oct. Futures flat. Nasdaq down 2.4%. Traders eye geopolitical risks.

US chip tariffs could hike prices 100%! SKorea's exports hit $709B, chips up 22%. Won eyes 1400/USD.

Dow, S&P 500 hit by tariff threats, worst day since Oct. Futures flat. Nasdaq down 2.4%. Traders eye geopolitical risks.

Dow futures rebound after Trump's Greenland threat sparks sell-off; Tesla & Nvidia skid, watch for volatility.

Must Read