- Prior +0.8%

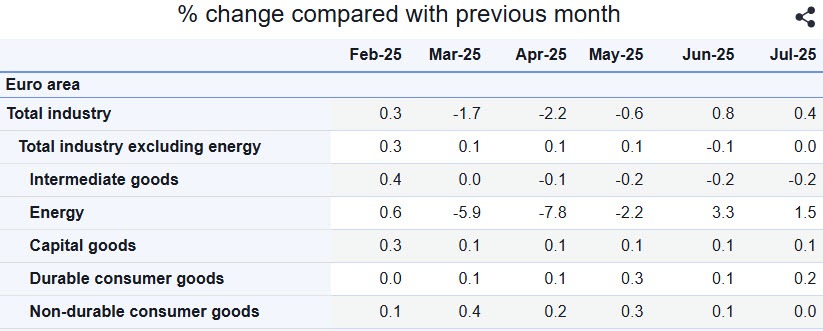

If you strip out energy prices, then producer prices actually were flat on the month and has been reflecting little change in general over the last few months. Here's the more detailed breakdown:

If you strip out energy prices, then producer prices actually were flat on the month and has been reflecting little change in general over the last few months. Here's the more detailed breakdown:

Most Popular

Greenland's rare earth riches face Arctic extremes, local opposition & strained EU ties. Billions needed for supply chain shift from China.

Dollar surges +0.79% on hawkish Fed nominee & strong PPI/PMI data. Gold & silver dump -11% & -31% on dollar strength.

Nikkei 225 futures show mixed price action; volume dips, open interest falls. Traders eye Feb '26 at 53280.

WTI crude dips -0.32% on de-escalated Iran tensions, while gasoline gains +0.36%. Watch storage levels & geopolitical risks.

Nat-gas surges 11% on cold snap & storage draws, but still below 3-yr high. Production offline.

DHS audits surge 3x in MN; businesses fear retaliation impacting sales & survival. Valuation metrics unclear.

AAPL dips on memory costs, but JPM sees buy-the-dip opportunity at 31x P/E, 24% upside to $315.

Must Read