- Prior -1.1%; revised to -1.3%

- Industrial production +0.9% vs +0.2% y/y expected

- Prior -1.7%; revised to -2.0%

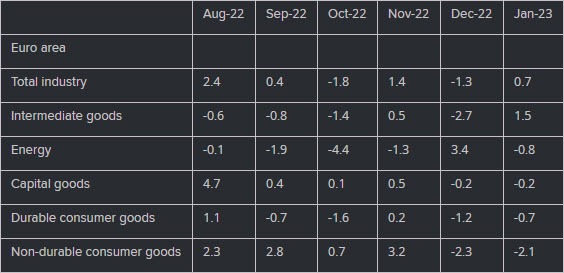

That's a decent beat but comes after a revision lower to the December figures. Here is the breakdown:

That's a decent beat but comes after a revision lower to the December figures. Here is the breakdown:

Most Popular

Sponsored

US shale jobs drop 1.7% as oil prices slide 12%. Producers cut costs, trim capex, and consolidate. Expect more layoffs.

EV tax credits ending! Grab your Tesla Model Y now or risk missing out on $11k savings. Prices are rising.

Gold surges 10% as markets ignore Fed rate cut hopes; 30-yr yields, dollar, bitcoin act weirdly. France downgrade adds risk.

US & UK ink tech deal! $700M in data centers, AI & chips to boost trillion-dollar sectors. Traders eye Nvidia & OpenAI.

ETH eyes $6.5K as $7.5B base forms! Analysts predict strong cycle, but watch for $5.2K resistance.

Oracle's cloud growth projections boost Nvidia, AMD, Broadcom, Micron. UBS sees 14x growth by 2030.

Fed poised for 25 bps cut amid sticky inflation. S&P 500, BTC, Gold eye gains, but short-term volatility likely.

Sponsored

Must Read