- Eurozone January Sentix investor confidence -1.8 vs -4.9 expected

- Prior -6.2

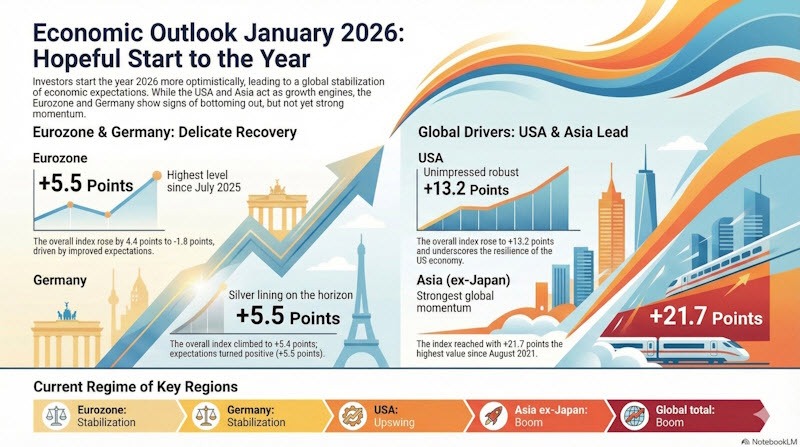

That marks the highest reading since July last year with a modest improvement seen especially in Germany. Sentiment towards Europe's largest economy nudged up by 6.3 points to -16.4, with the expectations component in particular sending a positive signal with an increase of 6.8 points.

A quick summary infographic by Sentix:

The commentary noted that private investors had been much more skeptical about the euro area economy even as professional investors were noticeably more positive. But the latest report now shows that private investors are now also coming on board, as the optimism continues at the start of the year.

Inflation concerns were less pressing with investors expecting prices to ease slightly, thereby reducing the pressure on the bond market.

Looking into detail, Germany showed a significant improvement in economic sentiment. However, the current situation index remains strongly recessive at -36.0 points. That indicates some doubt on whether the investment blockade will be lifted and Germany will regain its footing in 2026.

As for the outlook of the US economy, investors remain calm. The overall index for the US rose from 9.7 to 13.2 points - the highest since February last year. That underscores the robustness of the US economy despite many political distractions.