- Prior +3.5%

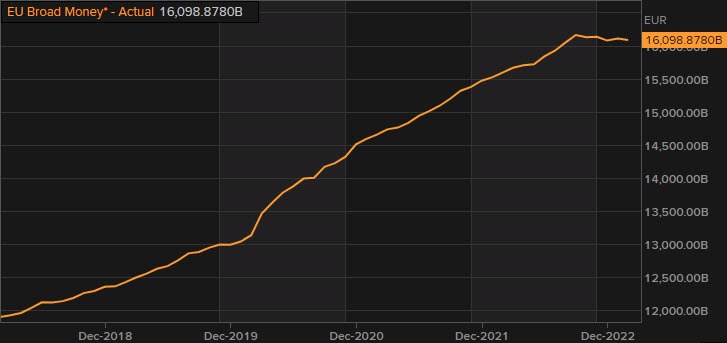

Broad money growth in the euro area continues to stagnate as the ECB drains up liquidity via their monetary actions but policymakers are reaffirming that banks in the region won't see a similar episode to SVB.

Broad money growth in the euro area continues to stagnate as the ECB drains up liquidity via their monetary actions but policymakers are reaffirming that banks in the region won't see a similar episode to SVB.

Most Popular

Intel beat Q4 earnings & revenue forecasts, with margins well above expectations. However, Q1 guidance disappointed, breakeven EPS & a weaker revenue and margin outlook, tempering near-term sentiment despite strength in Datacenter and Foundry units.

Trump's $200B housing plan offers marginal rate cuts; supply issues persist. Geopolitics may hike borrowing costs.

CD rates up to 5% APY, but Fed rate cuts loom. Lock in now or risk lower returns. Compare options!

Trade tensions ease! LXFR, CTOS, TEX jump 3%+ on Greenland deal framework. LXFR hits 52-wk high, but 5-yr return is negative.

Black swan risks: Iran oil shock (38% chance yields rise then fall), China tech breakthrough (coin-toss bubble burst), Russia/NATO war hits US GDP.

RDW jumps 17.6% on Greenland deal hopes; LASR +5%, DDD +9%, BLNK +7.9%, GLDD +8%. Trade fears ease.

Geopolitical relief sparks rally! AKAM +3.4%, APPN +2.9%, TTD +3.6%. TTD trades 70% below 52-wk high.

Must Read