- Composite PMI 52.0 vs 52.3 prelim

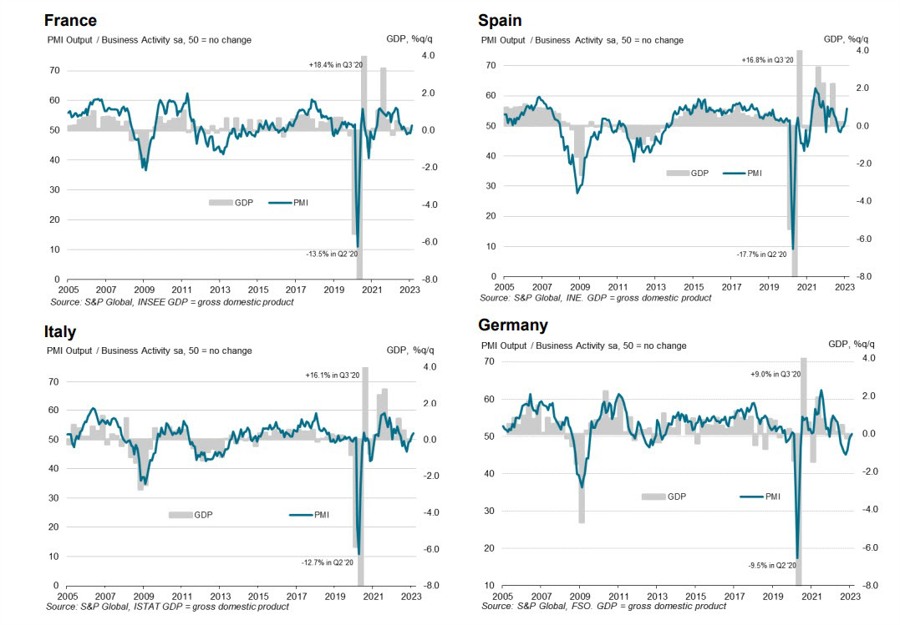

Both the services and composite readings are 8-month highs, reaffirming a modest bounce in activity in the Eurozone for the month of February. As seen below, there are decent upticks in overall activity across the German, French, Italian, and Spanish economies upon the turn of the year:

S&P Global notes that:

“A resounding expansion of business activity in February helps allay worries of a eurozone recession, for now. Doubts linger about the underlying strength of demand, especially as some of the February uplift appears to have been driven by temporary drivers, such as unseasonably warm weather and a marked improvement in supplier delivery times – likely linked in part to China’s recent reopening.

“Nevertheless, there are clear signs that business confidence has picked up from the lows seen late last year, buoyed by fewer energy market concerns, as well as signs that inflation has peaked and recession risks have eased.

“Not only has the upturn in confidence led to a welcome return to growth of output across both manufacturing and services, but firms are also back in hiring mood to suggest an increasing appetite to invest in expansion in the light of brightening business prospects.

“There is a concern, however, that signs of persistent elevated selling price inflation , combined with the surprising resiliency of the economy, will embolden the ECB into more aggressive monetary policy tightening, which poses a downside risk to demand growth in the months ahead.”