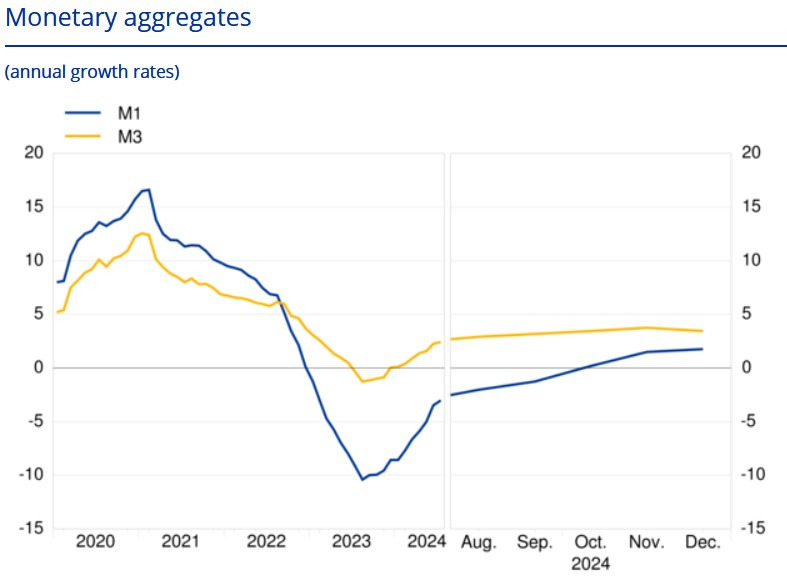

- Prior was +3.8%

- Loans to Households Y/Y 1.1% vs. 1.0% expected and 0.9% prior.

- Loans to Companies Y/Y 1.5% vs. 1.0% prior.

Most Popular

Nikkei 225 hits record highs, up 0.89%, as election jitters fade. Yen weakens, boosting exporter valuations.

Nikkei jumps 4.5% on election results; Kospi up 4.5%. US markets rally, tech stocks recover.

Nikkei 225 jumps 4.5% on election results! Stronger majority fuels market optimism.

Japan escalated yen warnings as Cabinet Secretary Kihara joined Finance Minister Katayama and top currency diplomat Mimura in flagging concern over rapid FX moves, signalling rising intervention risk amid renewed yen pressure.

UAE's $500M deal with Trump family's World Liberty Financial sparks scandal, raising valuation questions.

Firmus secures $10B debt for AI infra build-out. Nvidia & Blackstone back growth, eyeing 1.6GW capacity.

AirAsia flight D7221 plummets 24k ft amid cabin pressure alert; safety concerns rise.

Must Read