- Prior 53.6

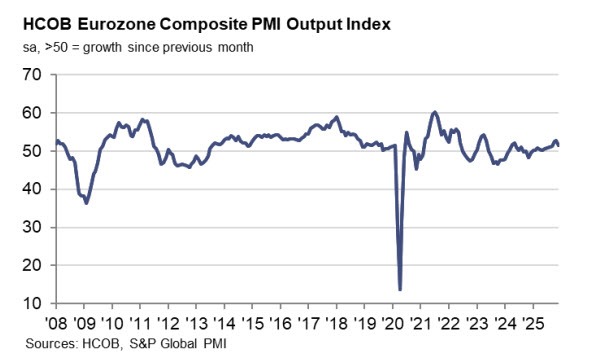

- Composite PMI 51.5 vs 51.9 prelim

- Prior 52.8

Both the services and composite readings are three-month lows as overall business activity in the euro area eased towards the end of 2025. A slower rise in demand for euro area goods and services was the main headwind on the month. Meanwhile, there were contrasting fortunes on price developments especially with that seen in Spain (hot) and France (cold). But at the balance, input cost inflation moved up to a nine-month high. So, that reflects some uptick in price pressures at the sector level but the pace of increase in output charges was unchanged from November at least.

HCOB notes that:

“The eurozone services sector has grown for seven months in a row. The pace of expansion slowed in December, but overall, the picture looks good. Companies have even increased their staffing levels more strongly, and new business indicates that they remain on a growth path. Overall, the recovery in services gained momentum in the fourth quarter, which is a good basis for starting the new year with confidence.

“The European Central Bank continues to monitor service inflation very closely, ECB President Christine Lagarde said at the interest rate press conference in mid-December, and rightly so, because cost inflation in this sector rose again in December. This in turn means that wages, which are the largest cost item for most service providers, will continue to increase at an above-average rate. This development, which was also accompanied by slightly higher inflation in sales prices, is, in our view, the most important reason why the ECB has not implemented any further interest rate cuts and does not appear to be planning any.

“The composite PMI averaged a visibly higher level in the last three months of the year than in the third quarter. Against this backdrop, GDP growth is likely to have accelerated. The decisive impetus is coming from the service sector, while manufacturing has slowed down. In 2026, the service sector should remain on a moderate growth path. The manufacturing sector is likely to benefit from higher demand for defence equipment and construction machinery, which are needed, among other things, to implement infrastructure projects in Germany. As a result, economic growth of well over 1 percent should be possible again, but is certainly not overwhelming.”