The major European indices are closing the day with gains across the board:

- German DAX rose 0.50%

- Frances CAC rose 0.45%

- UK's FTSE 100 rose 0.31%

- Spain's Ibex rose 0.56%

- Italy's FTSE MIB +1.0%

For the trading week:

- German DAX fell -0.30%

- Frances CAC fell -0.24%

- UK FTSE 100 fell -0.31%

- Spain's Ibex rose 0.95%

Looking around other markets as London/European traders look to exit, US stocks have turned negative:

- Dow industrial average down to 73 points or -0.22%

- S&P index -12 points are -0.29%

- NASDAQ index -54 points are -0.44%

In the US debt market

- 2 year yield 3.985% +7.9 basis points

- 10 year yield 3.436% +3.9 basis points

- 30 year yield 3.755% +1.1 basis points

In the European debt market this week, the benchmark 10 year yields are little changed:

- German 10 year yield is at 2.269%, unchanged on the week

- France 10 year 2.856% -1.0 basis points

- UK's 10 year 3.775%, unchanged

- Spain's 10 year 3.357%, unchanged

- Italy 10 year 4.176% -1.8 basis points

Looking at other markets:

- Crude oil gave up its earlier gains (high price reached $71.78) and is trading now down around $0.70 at $70.14

- Gold is trading down $4.54 or -0.23% at $2010.31

- Silver is trading down $0.27 or -1.13% at $23.89

- Bitcoin is trading lower at $26,319. At 5 PM yesterday the price was trading just above the $27,000 level

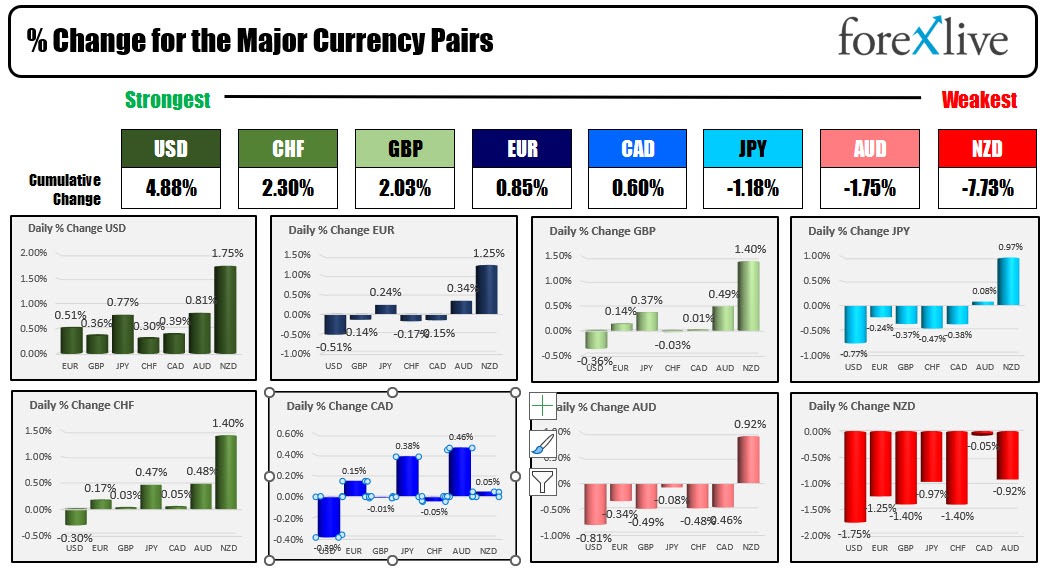

The USD is the strongest of the majors and the NZD is the weakest. The USD moved higher after the Michigan five-year inflation expectations rose to the highest level since 2011. Flight to safety flows from debt ceiling/budget concern and higher rates are also propelling the US dollar higher today.

The strongest to the weakest of the major currencies