Mixed Signals: Stocks are riding high on economic optimism, but bonds are telling a story of slower economic growth. This split view could lead to overall bearish surprises for equities should the bond market prove to be correct.

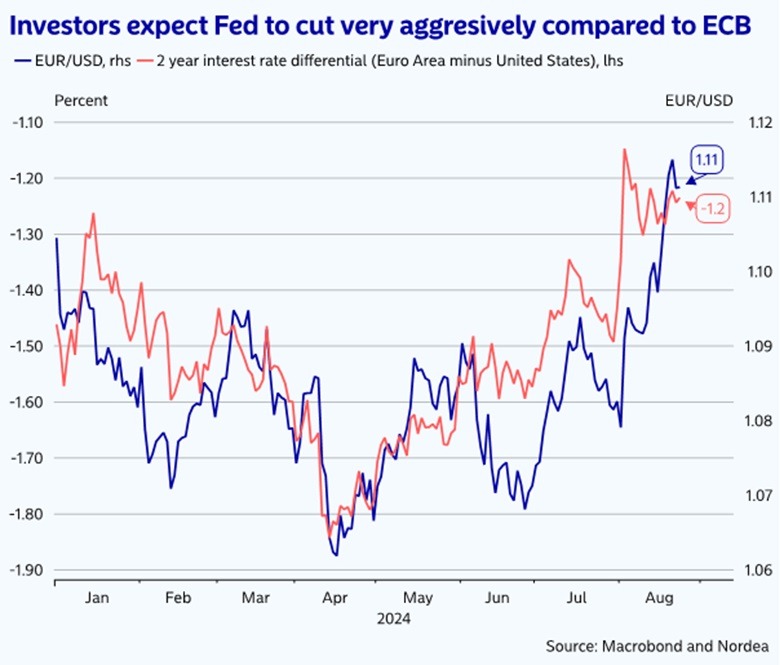

Rate Cuts on the Horizon?: The Fed is currently expected to cut rates by more than the ECB. Bond markets see the Fed cutting a lot in the next year, signaling some unease about the economic outlook, but seems strange when compared to EU growth and expected cuts from the ECB.

USD: The weak Dollar seems out of sync unless the US economy really starts to slow materially.

Market Moods: With stocks near peaks and bonds betting on a downturn, any further good news for equities might be hard to come by without clear economic gains.

- Stocks: Might be too pricey unless the economy kicks up a notch.

- Bonds: Could be overly gloomy unless the data starts to really deteriorate from here.

- USD: Without a material economic downturn the Dollar's recent downside looks overdone. Interest rate differentials have already priced in a fair amount as well