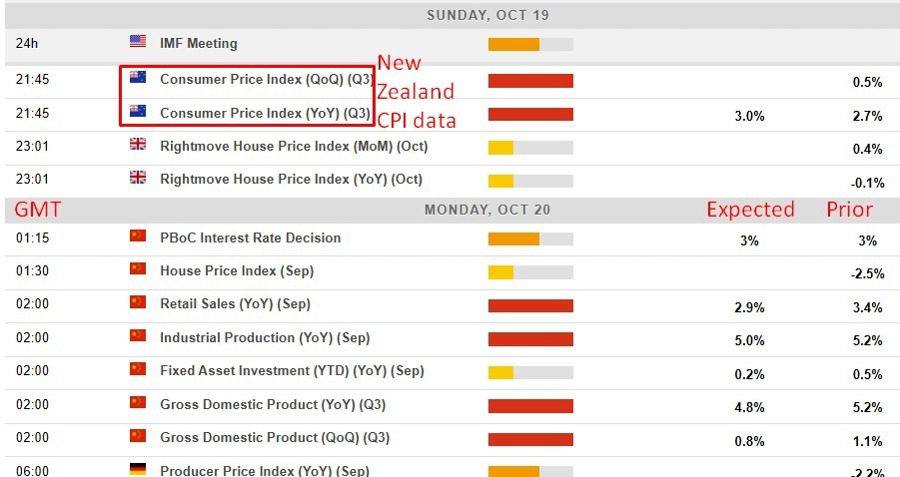

New Zealand Q3 2025 inflation data is not expected to be too helpful to the Reserve Bank of New Zealand. The Bank is continuing to cut rates on growth fears, but today's data is expected to show higher y/y inflation.

From China we have September 'economic activity'

- the rates of growth are expected to have slipped a little on all three main measures

along with Q3 GDP

- also expected to show a slightly slower rate of growth

The rate setting from the People's Bank of China is due also. No change is expected. The loan prime rate (LPR):

- one-year currently 3.00%

- five-year LPRs currently 3.50%

The main policy rate is now the seven-day reverse repo rate, currently at 1.4%.