I get the question a lot, "What time is the Bank of Japan announcement due?"

The answer is always the same, the BoJ doesn't have a scheduled time for their Statement, never do.

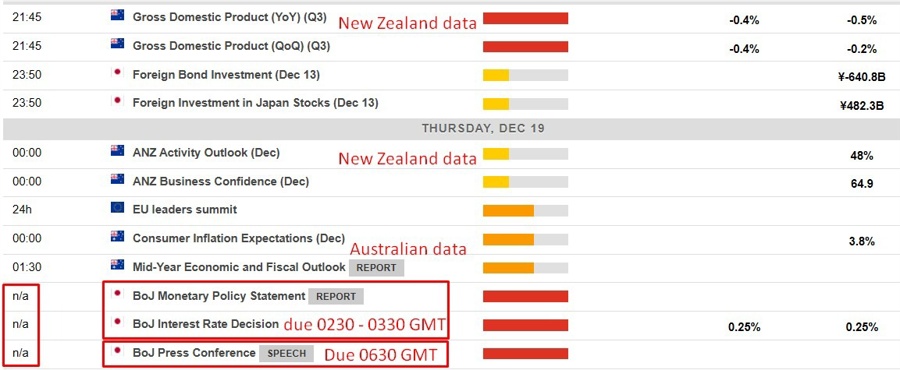

Experience indicates to expect it sometime in the 0230 - 0330 GMT (2130-2230 US Eastern time) time window.

Bank of Japan Governor Ueda will follow up with a press conference. This is scheduled. At 0630 GMT (0130 US Eastern time).

Earlier previews:

- BOJ reportedly sees little cost to waiting for next rate hike

- BOJ reportedly erring towards keeping interest rates unchanged

- BOJ reportedly considers skipping rate hike

- BOJ to raise interest rate to at least 0.50% by end-March, 51 of 52 economists say

- Goldman Sachs expect the Bank of Japan to remain on hold at 0.25% at the December meeting

- This snapshot from the ForexLive economic data calendar, access it here.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the 'prior' (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.

- I’ve noted data for New Zealand and Australia with text as the similarity of the little flags can sometimes be confusing.