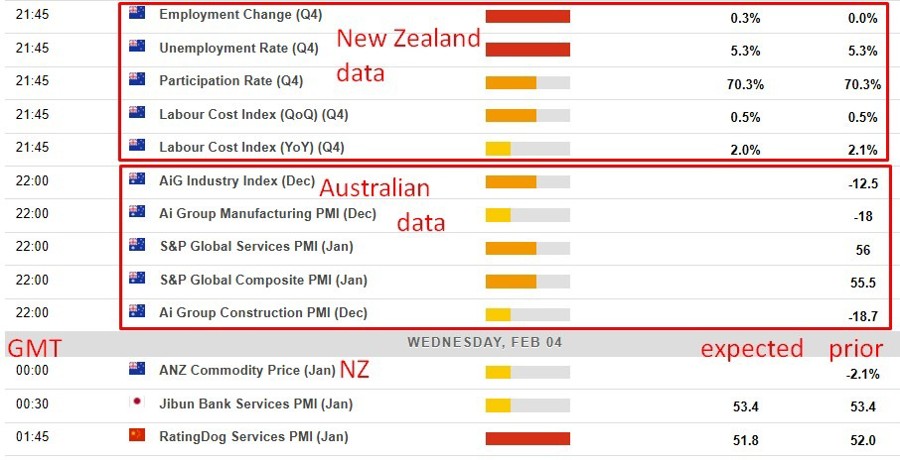

New Zealand Q4 2025 employment report and China's private survey services PMI feature on the calendar today.

New Zealand’s labour market is expected to show signs of stabilisation in the December quarter, with the unemployment rate forecast to remain steady at 5.3%. Recent higher-frequency indicators suggest a modest pickup in employment growth over recent months, broadly sufficient to keep pace with growth in the working-age population rather than deliver a material tightening in labour conditions.

If realised, the Q4 outcome would likely mark the peak in the unemployment rate for the current cycle. However, any improvement is expected to be gradual rather than sharp. While hiring momentum appears to be improving at the margin, underlying labour market slack remains evident, limiting the scope for a rapid decline in unemployment over the coming quarters.

This lingering slack is also expected to keep wage pressures contained. Firms continue to report a more balanced labour market, with easing skill shortages and reduced urgency to bid up wages compared with earlier in the cycle. As a result, wage growth is likely to remain moderate for some time, even as employment conditions slowly improve.

Overall, the labour market backdrop remains consistent with a cautious economic recovery rather than a strong re-acceleration. For policymakers, the data should reinforce the view that inflation risks from wages are limited in the near term, supporting a patient approach as broader economic conditions continue to evolve.

**

China's official services (and manufacturing) PMI disappointed in January:

China January PMI slips into contraction as weak demand clouds early-2026 growth outlook

China’s official manufacturing PMI slipped back into contraction in January, underscoring persistent domestic demand weakness at the start of 2026.

Services and construction activity also fell into contraction, marking the weakest non-manufacturing reading since late 2022.

New orders and export orders both deteriorated, signalling fragile momentum beyond seasonal effects.

Policymakers are accelerating targeted fiscal and monetary support, but confidence in a rapid demand rebound remains limited.

Official optimism around high-tech and export resilience contrasts with softer consumption and property-sector stress.

However, the private survey manufacturing PMI was not as bad:

China private manufacturing PMI rises in January, but cost pressures intensify

China’s private-sector manufacturing PMI edged higher in January, signalling a second straight month of modest expansion.

Output and new orders improved, with overseas demand—particularly from Southeast Asia—providing support.

Employment rose slightly and backlogs eased, pointing to marginal operational improvement.

Cost pressures intensified, pushing factory-gate prices higher for the first time in over a year.

The private PMI contrasts with weaker official PMI data, highlighting a still-fragile and uneven recovery.

The PMI due today is expected to have slipped from December but to remain well in expansion territory.