Credit Agricole is out with a note at the end of last week saying that the dollar will remain in the crosshairs for trading this week. That as traders will have plenty to look forward to this week as well, following the key economic data trifecta last week.

The firm argues that all things considered, the dollar could find some opportunities to seek relief in this kind of environment:

"Looking ahead into next week, the ‘USD rebalancing’ theme could remain quite important and investors will scrutinise the TIC data for December looking for any indications that foreign demand for USTs and US stocks has started to taper off.

In addition, market participants will focus on core PCE deflator data for December, PMIs for February as well as the minutes from the January FOMC meeting and Fedspeak. FX investors will further keep an eye out for any headlines regarding SCOTUS’ long-anticipated verdict on the trade tariffs of the Trump administration.

In all, we continue to think that many Fed-related negatives are already in the price of the USD and would expect the currency to consolidate in the absence of data disappointments and/or dovish surprises from the Fed in the near-term. It would take evidence that international investors continued to buy US assets, however, to give the USD a more lasting reprieve."

As a reminder, there are two key risk events to watch out for outside of the usual economic calendar this week. The first being the US Treasury TIC report for December 2025, which is scheduled for 18 February.

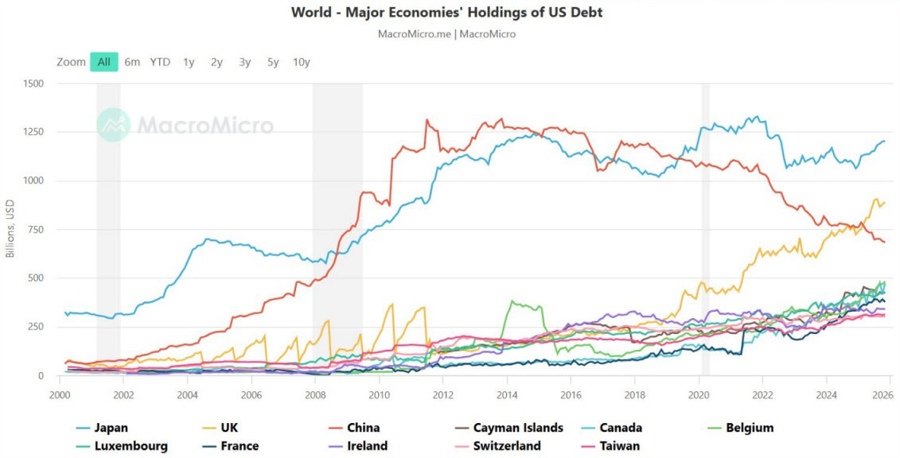

The report continues to be a crucial one in scrutinising foreign investors' appetite for US debt. For some context, their holdings reached a record $9.36 trillion in November 2025. And that is despite a further drop in China holdings, which declined to its lowest since 2008.

That being said, it is best to reminded that this data doesn't fully measure China's holdings of US Treasuries. It instead measures China's holdings of Treasuries in US custodians. That's a very important distinction to be mindful about. Why so you might ask?

Because China could be, and almost certainly, is still buying Treasures via non-US custodians. And some of the biggest names in this context are the likes of Belgium and Luxembourg, whose holdings are going toe-to-toe with some of the major players in the world.

And the other key outside risk event this week will be the potential US Supreme Court decision on Trump's tariffs. The next opinion hearing date is scheduled for 20 February, so that could introduce some end of week risk for markets to be mindful of.

More on that: US Supreme Court says next Friday will be a decision day