Economists at CIBC review the August CPI report and note that while it came in a bit hot, it's not hot enough to keep the FOMC from cutting rates by 25 basis points next week.

"There wasn’t much in today’s report that will sway this FOMC not to cut in September," economist Ali Jaffery wrote. "The bigger story is the job market is in need of support, and an ailing job market implies more muted demand-side price pressures ahead."

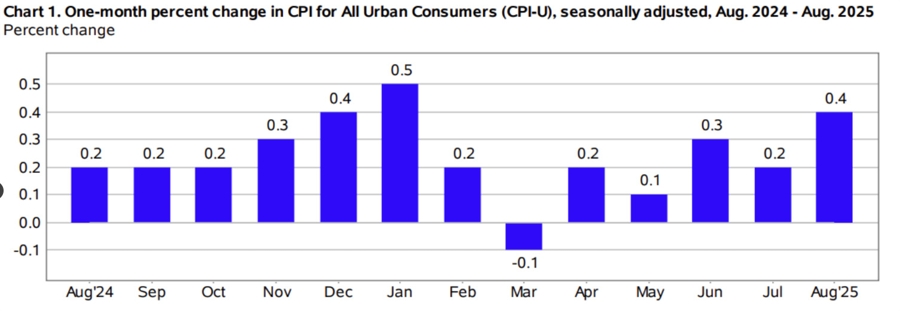

On an annual basis, core stayed unchanged at 3.1% while headline rose two ticks to 2.9%, both as expected. More worrisome is signs that price hikes are creeping in.

"Tariff pass-through picked up in the month, with core goods prices rising by their fastest pace since broad-based tariffs were imposed. We saw the first noticeable rise in new car prices in today’s report, suggesting tariff-impacts could be broadening to larger- ticket items although car prices still look tame."

CIBC expects the Fed to cut in September and October the pause and assess with two more cuts in the first half of next year. Market pricing suggests 121 bps in easing through June of 2026.

"The overall inflation picture in the US is still pretty distant from target, something the Fed will be ok with for now as they worry about the prospect of dimming economy and job market that is starting to show slack. If we lived in a parallel universe where there wasn't a strong bias wasn't to bring rates lower, we're not so sure the Fed would be eager to cut and the market would take a more gradual view of easing."

The Fed decision is September 17.