Stocks push higher

The S&P 500 is up 76 points to 4670, breaking the 61.8% retracement level and underscoring the buy-the-dip mentality in stocks. It's an impressive rebound from Friday's rout despite the continued uncertainty around omicron.

At the same time, perhaps it underscores that the only thing that really matters is the Fed and omicron probably kills the chance of a faster taper announcement in December.

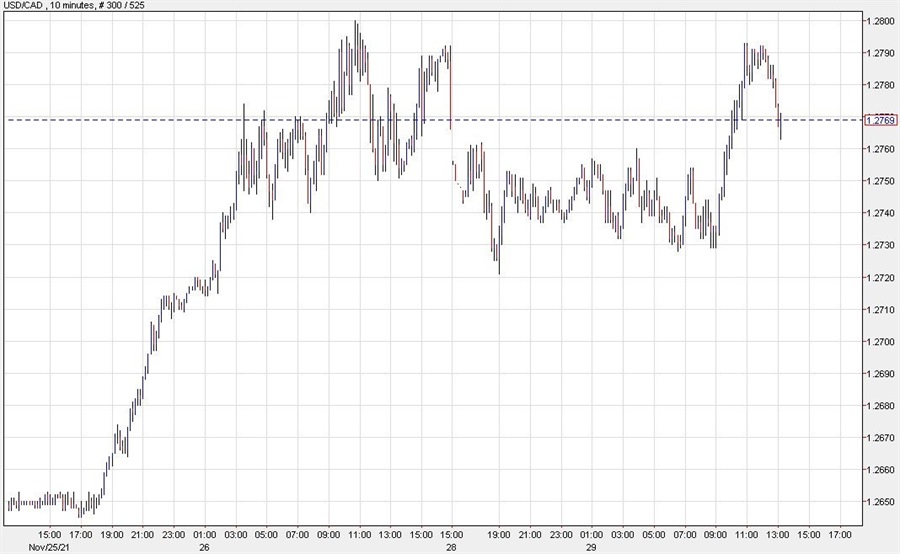

The commodity currencies are tracking the improved sentiment closely despite some divergences in underlying commodities. USD/CAD fought back a third challenge of 1.2800 and is down to 1.2770.