- Prior was +0.4%

- 16% trimmed mean: +0.2% vs +0.3% prior

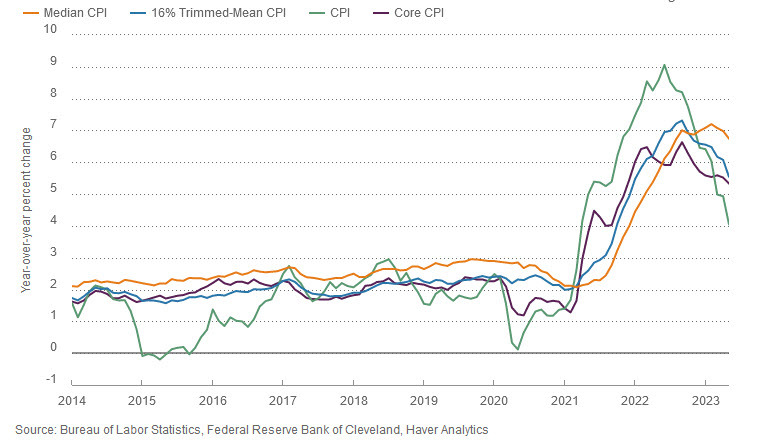

These aren't market moving numbers as they recalculate CPI data was released earlier today. Still, they offer some insight into what the Fed is looking at.

Median CPI is slow to roll over.

These aren't market moving numbers as they recalculate CPI data was released earlier today. Still, they offer some insight into what the Fed is looking at.

Median CPI is slow to roll over.

Most Popular

Strive's SATA preferred stock (12.25% yield) eyes $150M raise to buy more bitcoin & cut debt. Common shares up 0.8%.

CD rates up to 5% APY, but Fed cuts loom. Lock in now or risk lower returns. High-yield savings offer flexibility.

Fed chair nominee Hassett eyes 5%+ growth, citing AI productivity. Sees 90s redux, favors Greenspan-style independence.

European defense stocks dip 3% on geopolitical jitters; JPMorgan sees buying opp. Rheinmetall at 40x earnings.

Laser Digital launches tokenized BTC yield fund targeting >5% excess return; minimum $250k for accredited investors.

Ark Invest sees BTC hitting $16T by 2030! Traders eye potential 1,159% gains amid cycle lows.

Iran's sanctions lift could add 1.5M bpd oil, dropping prices 10%. Non-oil trade may hit $182B. Watch energy & logistics shifts.

Must Read