China Gold Association reports gold consumption fell in Q1

- down 5.96% to 290,492 metric tons

- Q1 domestic mined gold output reached 87.243 tons, up 1.49% y/y.

- Gold ETF holdings in China in Q1 increased by 23.47 tons, up 327.73% y/y

More (via Reuters):

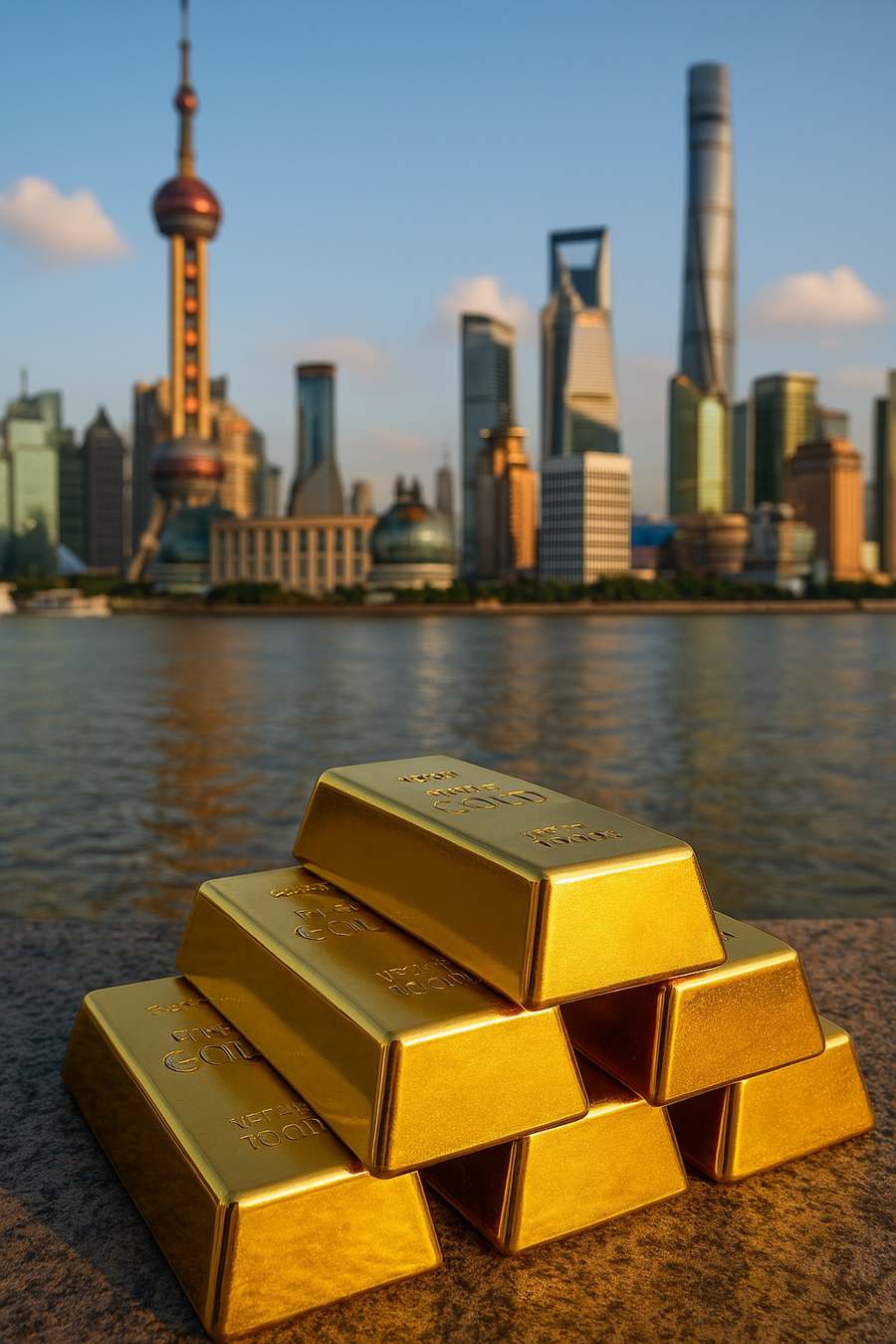

- China’s gold consumption dropped nearly 6% in Q1 2025, with soaring prices pushing consumers away from jewellery and toward investment products like bars and coins.

- Demand for gold bars and coins surged as investors sought safe-haven assets amid rising geopolitical and economic uncertainties.

- Total gold consumption in China fell 5.96% year-on-year to 290.492 tonnes in Q1 2025.

- Gold jewellery demand plummeted 26.85% to 134.531 tonnes due to higher gold prices.

- Investment-driven consumption of gold bars and coins jumped 29.81% to 138.018 tonnes.

- Consumers increasingly view gold as a safe-haven investment amid global volatility. • The shift highlights growing financial caution among Chinese consumers in 2025.