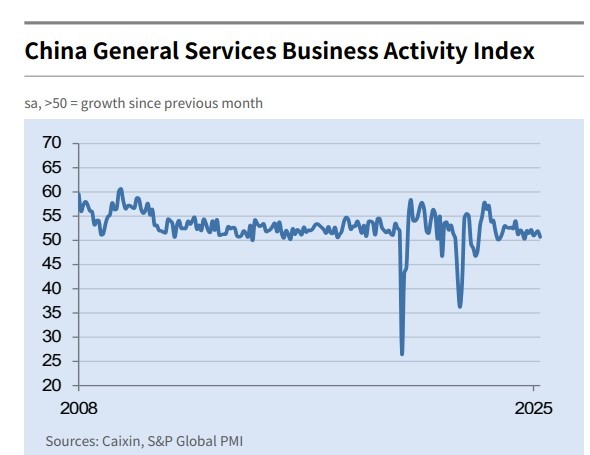

China Caixin Services PMI for April 2025:

Services PMI 50.7, slowest since September 2024

- expected 51.7, prior 51.9

Composite 51.1

- prior 51.8

Commentary/analysis, summarised from the report:

Growth in business activity and new orders slowed, with the latter rising at its weakest pace since December 2022.

Employment contracted for the second month, as firms cut staff to manage costs, leading to higher backlogs.

Input costs rose, driven by wages and raw materials, while prices charged fell for the third month, amid weak demand and competition.

Market optimism dropped sharply, with future expectations falling to the second-lowest on record, reflecting concerns over U.S. tariffs.

Foreign tourism provided some support to export orders, but overall demand remained subdued.

---

These are the final of the PMIs due from China for April.

Earlier we've had:

China March official Manufacturing PMI 49.0, this is a 16-month low (the worst contraction since December 2023) expected 49.8, prior 50.5

- Non-Manufacturing PMI 50.4 (services and construction)

China Caixin Manufacturing PMI for April 2025 comes in lower than March but better than expected at 50.4