China Caixin Manufacturing PMI for April 2025 comes in lower than March but better than expected at 50.4

- expected 49.9, prior 51.2

The details, though .... slowing demand, falling export orders, and rising trade tensions knocked China’s factory momentum in April, with sentiment near record lows.

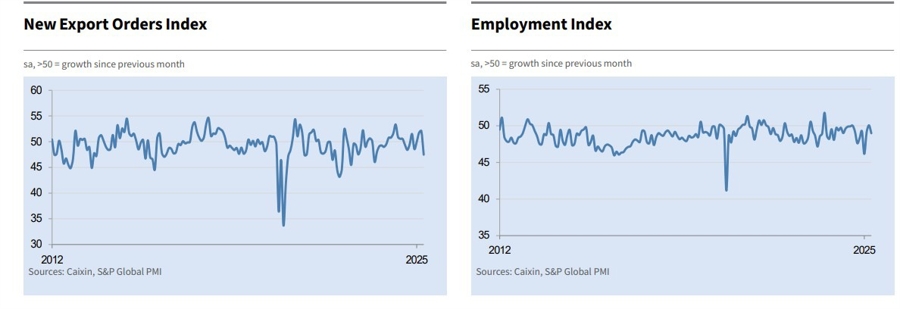

Demand & Output: New orders rose only slightly; export orders dropped at the fastest pace since July 2023 due to U.S. tariffs. Output remained in expansion for an 18th month.

Employment: Jobs shrank again after a brief rebound in March — layoffs most common in investment and intermediate goods sectors.

Prices: Input costs declined for a second month, driven by weaker commodity prices; firms cut output prices for a fifth straight month.

Logistics & Inventory: Supply chains faced delays linked to trade tensions; firms ran down inventories amid weak demand.

Business Confidence: Optimism dropped sharply, hitting the third-lowest level on record, with firms citing trade uncertainty.

Policy Outlook: Early-year momentum is fading; analysts warn tariff shocks will weigh on growth in Q2–Q3, urging faster policy support.

Earlier from China, the official PMIs: