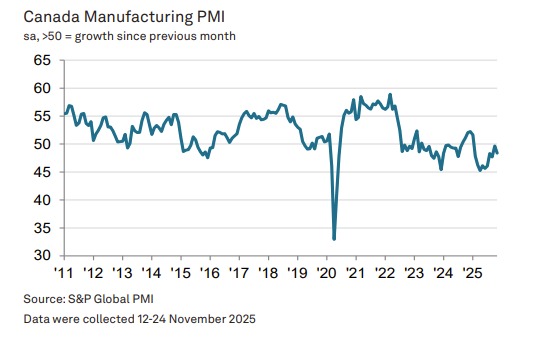

- Prior month 49.6

- S&P Global manufacturing PMI 48.4

- The index has been below the critical 50.0 no change more for 1/10 consecutive month

- Similar trends were observed for both production and new orders. Firms continued to note a general air of uncertainty in product markets, which resulted in subdued demand and modest contractions in both output and new work. This was again especially the case for new export trade, which fell for a tenth successive month in November.Tariffs remained a factor weighing on international demand.

- The general lack of demand and falling production requirements tended to discourage firms from hiring additional workers in November.

Firms had enough capacity to handle workloads, shown by a steep and accelerated drop in backlogs—the sharpest contraction since July.

Business confidence stayed positive, supported by hopes that new product launches would attract new clients.

Overall confidence, however, remained historically subdued due to ongoing uncertainty, particularly around tariffs.

Despite expectations for higher production, firms cut purchasing activity and relied more on existing inventories.

Both buying activity and stocks of purchases posted their largest declines since July.

Longer supplier delivery times also pushed firms to use existing inventory, and many reported shortages of inputs at vendors.

Tariffs and higher supplier charges raised input costs in November, though overall inflation slowed to its weakest pace in over a year.

This softer cost environment contributed to a slower rise in output prices, with competitive pressures further limiting firms’ ability to increase selling prices.

From Paul Smith, Economic Director:

- Canada’s manufacturing sector remained in the doldrums during November, experiencing concurrent – and accelerated – drops in output and new orders. Market uncertainty, again linked to tariffs especially in relation to international trade, was again noted by panellists as leading to subdued performance.

- Firms were subsequently keen to utilise existing capacity to deal with current workloads and generally refrained from purchasing inputs or replacing any leavers at their plants. Workforce numbers subsequently fell further.

- However, there is some hope that the worst is behind the sector. The contraction in November was relatively shallow (despite accelerating since October), whilst the impact of tariffs on prices is fading with input price inflation dropping to its lowest level in over a year. With selling charges also rising at a below-trend pace, inflationary pressures appear increasingly well contained heading into the end of 2025.