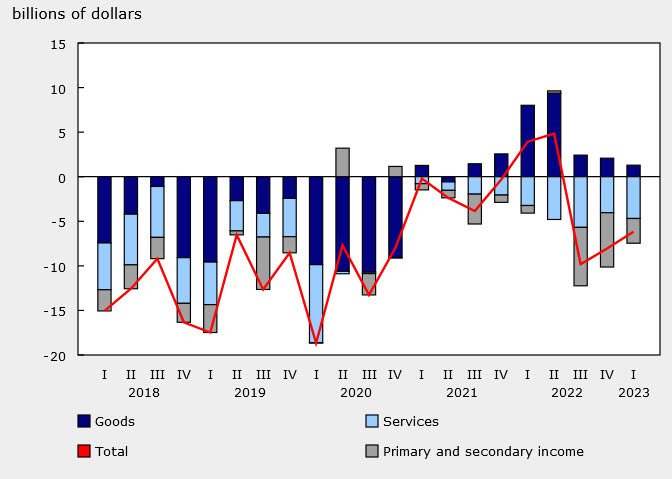

- Prior was -10.64B (revised to -8.05B)

- Trade deficit $3.4B vs $2.0B in Q4

- Investment deficit $0.9B

The lower deficit mainly reflected a smaller investment income deficit, partially offset by a higher trade in goods and services deficit.

The lower deficit mainly reflected a smaller investment income deficit, partially offset by a higher trade in goods and services deficit.

Most Popular

US investors eye Venezuela's oil reserves & debt restructuring. Opportunity knocks!

Japan Display's US factory eyed for $550B gov't package. Potential boost or risk?

Night shift jobs down 10% since 2000. Fewer workers mean higher labor costs for some industries.

TSLA: AI bets fuel robotaxi vision, BofA sees $460 target despite EV slowdown. High risk, high reward.

Gas prices jump 14% on Iran conflict fears. Budget for $4/gallon. Energy sector sees volatility.

BLK shares dip as private credit fund limits redemptions amid outflows. Risk rises, valuation questioned.

GOOGL & NVDA lead AI race. Investors eye 10-yr returns, weighing growth vs. current valuations.

Must Read