- Prior was 2.2%

- Inflation m/m +0.1% vs +0.1% prior

- BOC core 2.9% vs 2.9% prior

- BOC core m/m -0.1% vs +0.6% prior

- Core CPI +0.2% m/m vs +0.3% prior

- CPI median +2.8% vs +2.9% expected

- CPI trim +2.8% vs +2.9% expected

- CPI common 2.8% vs 2.7% prior

- Ex gasoline +2.6% vs +2.6% prior

This is generally good news for the Bank of Canada as the monthly numbers were benign.

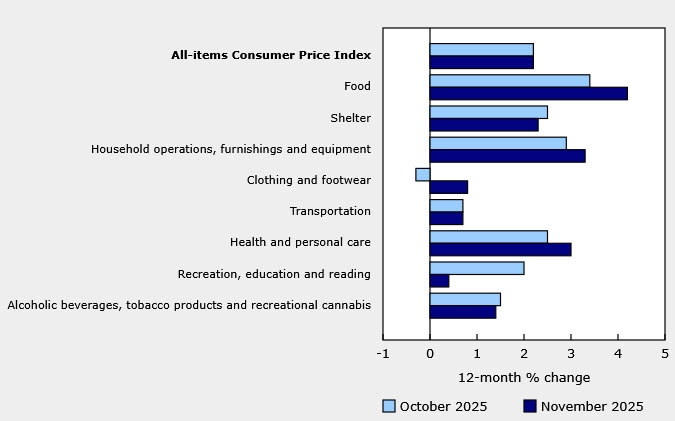

Lower prices for travel tours and traveller accommodation, in addition to slower growth for rent prices, put downward pressure on the all-items CPI, Statistics Canada said. Offsetting the slower growth in services on an annual basis were higher prices for goods, driven by price increases for groceries as well as a smaller decline for gasoline prices.

For Canadians, the 4.7% y/y rise in grocery prices (up from +3.4%) will bite hard and is the highest y/y rise since Dec 2023. Fresh fruit was a strong component of the increase but the headline rises were in frozen been (+17.7%) and coffee (+27.8%).