- Manufacturing sales prior month 0.3%

- Manufacturing sales for July 2.5% versus 1.8% estimate

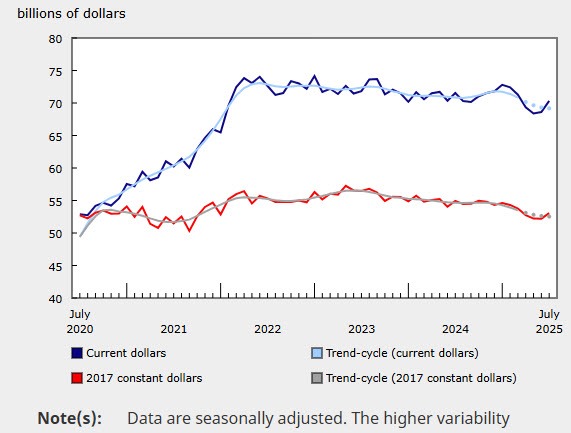

Canada Wholesale Trade statistics for July:

- Prior month 0.7%

- Wholesale trade 1.2% vs 1.3% estimate

Subsector gains: 4 of 7 subsectors rose, covering ~75% of wholesale trade

Motor vehicles & parts: +5.1%

Building materials & supplies: +2.7%

Year-over-year: +4.3% vs July 2024

Volume terms: +0.8% in July

Details of the manufacturing sales shows:

Transportation equipment sales rebounded +8.6% to $11.4B in July after four monthly declines.

Motor vehicles: +11.4%

Motor vehicle parts: +7.2%

Aerospace products and parts: +6.5%

Seasonal shutdowns in Ontario were less pronounced this year due to a broader production slowdown linked to new US tariffs.

Exports of motor vehicles and parts rose +6.7%.

Aerospace manufacturers showed stronger-than-usual July output, reflecting solid demand.

Petroleum and coal product sales increased +6.2% to $7.2B in July (after +11.6% in June).

Growth driven by ramp-up in refined petroleum production after April–May refinery shutdowns.

Sales in constant dollars: +4.5%.

Year-over-year sales: -12.7% despite recent gains.

Total inventories rose +0.8% to $121.2B in July.

Goods in process: +2.0%

Raw materials: +1.0%

Finished products: -0.5%

Machinery: +3.8%

Petroleum & coal products: +2.6%

Miscellaneous manufacturing: -10.3%

Inventory-to-sales ratio fell to 1.72 from 1.75 in June, indicating slightly quicker turnover.

Unfilled orders edged down -0.1% to $112.3B, with notable declines in miscellaneous manufacturing (-14.1%) and plastics & rubber (-9.0%).

The Bank of Canada will meet this week and announce its interest rate decision at 9:45 AM ET on Wednesday. The central bank is expected to cut rates by 25 basis points.