- Prior month -1.1% revised to -1.2%

- The advanced estimate of retail sales, suggested that sales increased 1.6% in June.

- Retail Sales June 1.5% vs 1.5% est.

- Retail sales ex Auto 1.9% vs -0.3% last month (revised from -0.2%

The advanced estimate for July suggests that sales increased increase by 0.8%.

Other details from the report:

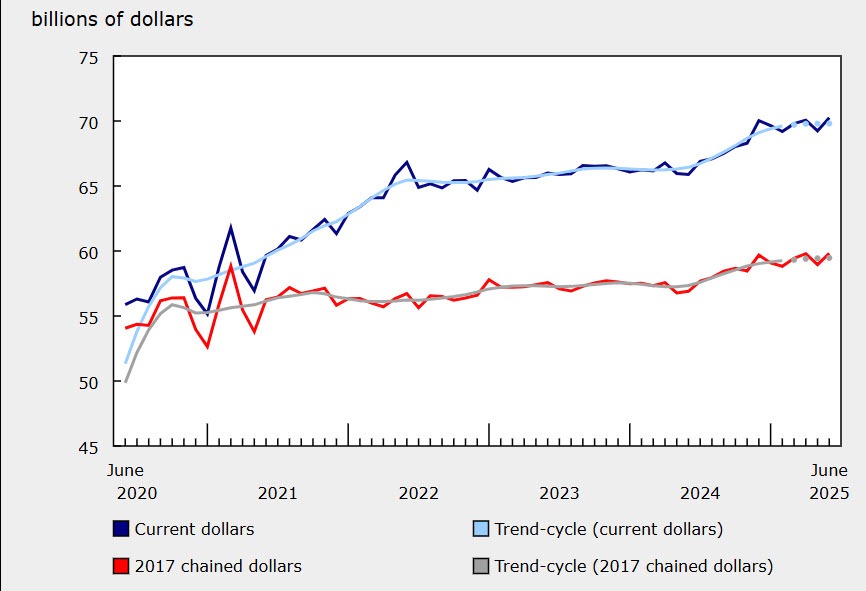

Headline sales: Retail sales +1.5% to $70.2B in June.

Sectors: Gains across all nine subsectors, led by food & beverage retailers.

Core sales: +1.9% in June (ex-gasoline stations, fuel vendors, motor vehicles & parts dealers).

Volume terms (June): +1.5%.

Quarterly sales (Q2): +0.4%.

Quarterly volume sales (Q2): +0.7%.

Trade tensions impact

27% of retailers reported being affected in June (down from 32% in May).

Main impacts: price increases, changes in demand, supply chain delays.

Core retail sales

Core retail sales +1.9% in June.

Food & beverage retailers +2.3% (all four store types posted gains).

Supermarkets & grocery retailers +1.8% (after -0.6% in May).

Beer, wine & liquor stores +4.3%.

Convenience stores & vending operators +5.3%.

Clothing & accessories +5.1%.

General merchandise retailers +1.6%.

Gasoline & autos

Gasoline stations & fuel vendors +1.8% (volumes +2.7%), ending three months of declines.

Motor vehicle & parts dealers +0.2% (after -3.4% in May).

New car dealers +0.1%.

Auto parts, accessories & tire retailers +1.1%.

Other vehicle dealers -0.1%.

Regional breakdown

Retail sales rose in 6 provinces.

Ontario +3.2% (Toronto CMA +3.9%), led by autos.

British Columbia +1.5% (Vancouver CMA +2.0%), led by building materials & garden supplies.

Saskatchewan -1.4%, decline tied to wildfire evacuations and lower auto sales.

The USDCAD was trading at 1.3916 ahead of the release. The price is currently trading at 1.3912.