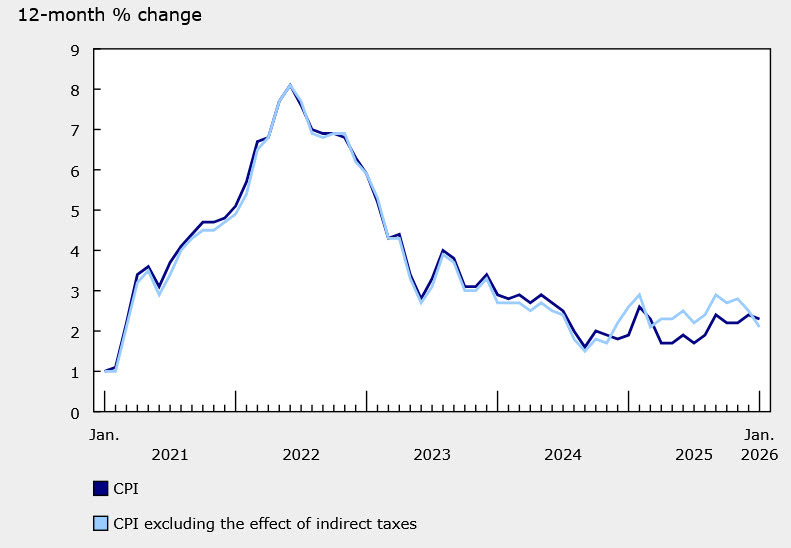

- Prior was +2.4%

- CPM m/m 0.0% vs +0.2% expected

- Prior CPI m/m -0.2%

Core measures:

- BOC core 2.6% vs 2.8% prior

- BOC core m/m +0.2% vs -0.4% prior

- Core CPI % m/m +0.1% vs +0.3% prior

- CPI median +2.5% vs 2.5% expected (prior was 2.6%)

- CPI trim +2.4% vs 2.6% expected (prior was 2.7%)

- CPI common +2.7% vs 2.8% prior

- Gasoline prices -16.7% y/y and -13.8% m/m

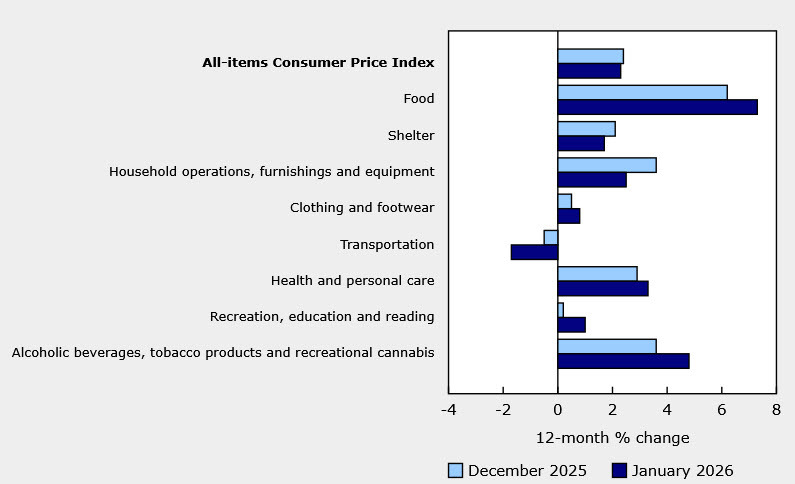

- Shelter +1.7% y/y (first time below 2% in five years)

This report on the headline isn't quite as dovish as it looks as a drop in gasoline prices was the largeest contributor to the undershoot. Excluding gasoline the overall CPI rose 3.0% y/y, the same as in December.

Aside from that, the impact of the temporary sales tax break (GST/HST) continues to reverberate as it leaves the index. The CPI has seen an acceleration in prices for restaurant meals, and to a lesser degree, prices for alcoholic beverages, toys and children's clothing. Food from restaurants was up 12.3% y/y

On an annual basis in January, prices rose at a slower pace in nine provinces compared with December. Year-over-year price growth accelerated in British Columbia due to a base-year effect, as prices for hotels declined on a monthly basis in January 2025 following an increase in December 2024 coinciding with a series of Taylor Swift concerts.

This chart excludes the Dec 2024-Feb 2025 tax holiday and shows a declining trend.