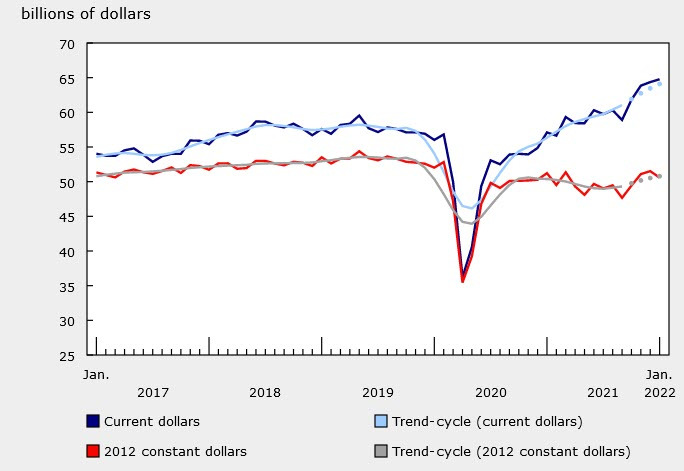

Statistics Canada released an early estimate of February manufacturing sales and sees the indicator up a healthy 3.7% based on 77.2% of responses. That's on the heels of a 0.6% rise in January.

Statistics Canada released an early estimate of February manufacturing sales and sees the indicator up a healthy 3.7% based on 77.2% of responses. That's on the heels of a 0.6% rise in January.

Most Popular

Dollar dumps to 4-yr lows on trade war fears; Gold surges 2.9% to $5,111 as safe-haven demand spikes.

Nat gas hits $6/MMBtu on deep freeze & depleted inventories. March futures rally continues, watch for supply disruptions.

VC titan Gurley warns AI valuations may correct as startups burn cash faster than Uber/Amazon. Profitability is key.

S&P 500 eyes 15% earnings growth at 22x forward earnings; tech lags as cyclicals gain.

UK job postings lag Europe, down 20%. Loading up 20%, nursing down 68%. Policy uncertainty & costs bite.

Goodwill sales surge, signaling cautious consumer spending amid economic uncertainty. Watch for shifts in retail valuations.

ETH preps for quantum risk, boosting its long-term value proposition vs. BTC. RIVER token moons 180%!

Must Read