The consensus call will continue to be for the Fed to hike by 50 bps surely but the off chance is that they might go with a surprise 75 bps rate hike instead. The only worry for the Fed is the way the market will receive that kind of decision.

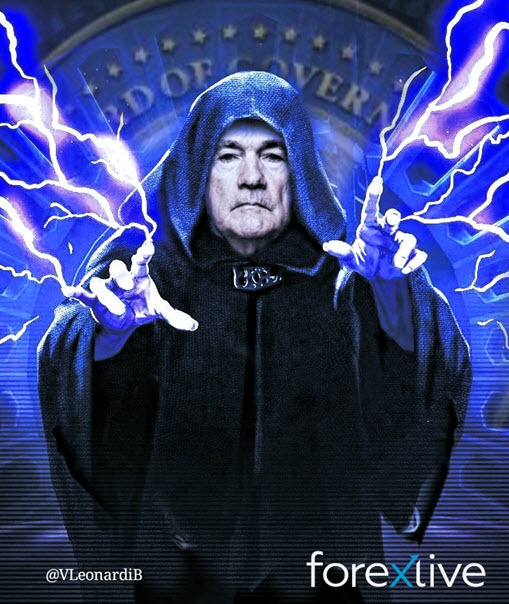

As things stand, we're already seeing quite a terrible showing across all asset classes since Friday and another bolt of lightning isn't going to help calm the nerves when the storm clouds are rampaging. A 75 bps rate hike will see significant repricing for subsequent Fed meetings and that will continue to stir plenty of anxiety in markets.