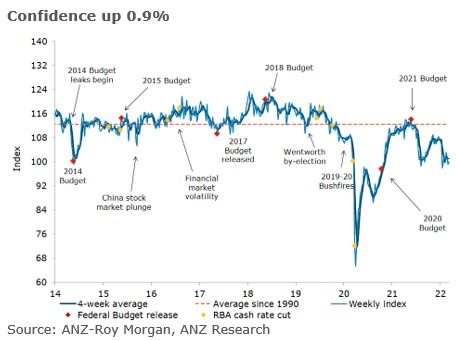

Higher on the week despite surging petrol (gasoline) prices in Australia. The level is still well below the long run average.

AUD is unresponsive (there is usually little to no response when this weekly indicator hits screens, so not unusual).

Higher on the week despite surging petrol (gasoline) prices in Australia. The level is still well below the long run average.

AUD is unresponsive (there is usually little to no response when this weekly indicator hits screens, so not unusual).

Most Popular

Gold hits $5,033, Wells Fargo targets $6,300. China's buying spree & Fed concerns fuel rally despite 21% drawdown.

FNF's 1.6x P/B valuation shows strong ROE, while EIG's 0.9x P/B & AGO's 0.7x P/B face growth & profitability woes.

Gold rebounds past $5K, recovering half its losses. Silver jumps 6%. Central bank buying supports.

NXPI beats revenue/EPS estimates, auto growth returns. Divestitures & comms weakness weigh. Buy?

ABBV's 113% 5-yr return, 15.1x P/E; CCB's 304% return, 2.3x P/B; BX's 82.8% return, 19.9x P/E.

GE's 47% EPS growth & 41.4x P/E vs. HD's 3.3% EPS drop & 25.7x P/E. NWPX shows 19.9% EPS growth at 19x P/E.

Quantum risk to BTC supply is low, says CoinShares. Only ~10.2K BTC at risk of market disruption.

Must Read