Non-Farm Payrolls +22K vs +75K expected

Private Payrolls +38K vs +75K expected. Prior 83k

Manufacturing Payrolls: -12K vs -5K expected. Prior -11k.

Government Payrolls -16K vs -10K prior

Unemployment Rate 4.3% vs 4.3% expected. Prior 4.2%

Average Earnings MoM +0.3% vs +0.3% expected. Prior 0.3%

Average Earnings YoY +3.7% vs +3.7% expected. Prior 3.9%

Average Workweek Hours 34.2K vs 34.3 expected Prior 34.3

Labor Force Participation Rate 62.2% vs 62.3% prior

U6 Underemployment 8.1% vs 7.7% prior

- Two-month net revision -22K

The US dollar is down across the board on this with USD/JPY down a half-cent. Gold is near a new record as the market prices in more Fed rate cuts on this.

The market is now fully priced for a September rate cut with about a 3% chance of a 50 bps cut. The larger action is further out the curve where the October meeting is now up to 80% for a cut from about 60% beforehand. For the year ahead, there is 130 bps of easing priced in.

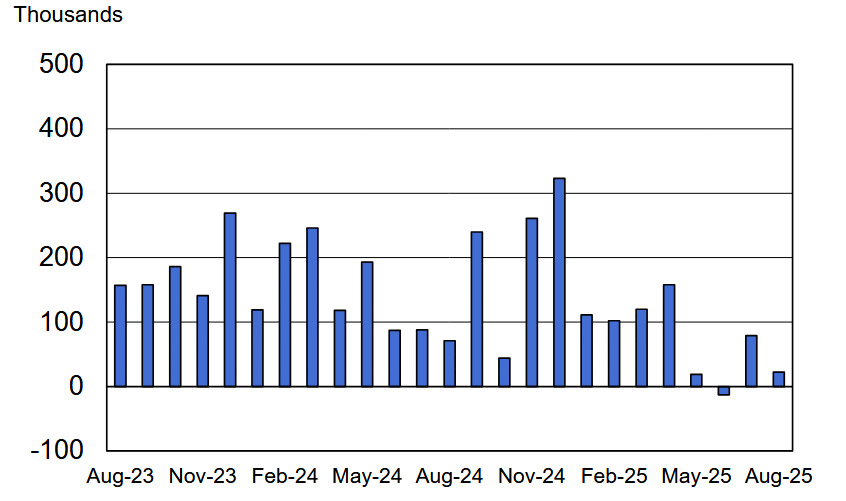

Looking at that chart, there is a very clear step down in May which isn't a big coincidence as it was the first month after Liberation Day.

The three-month average of jobs creation is just 29K. The stock market is teetering between taking this as a sign that the economy is slow but not terrible versus fear that a recession is coming.

I was worried we would see some manipulation in the data after the BLS head was fired but it's hard to see that in today's number.