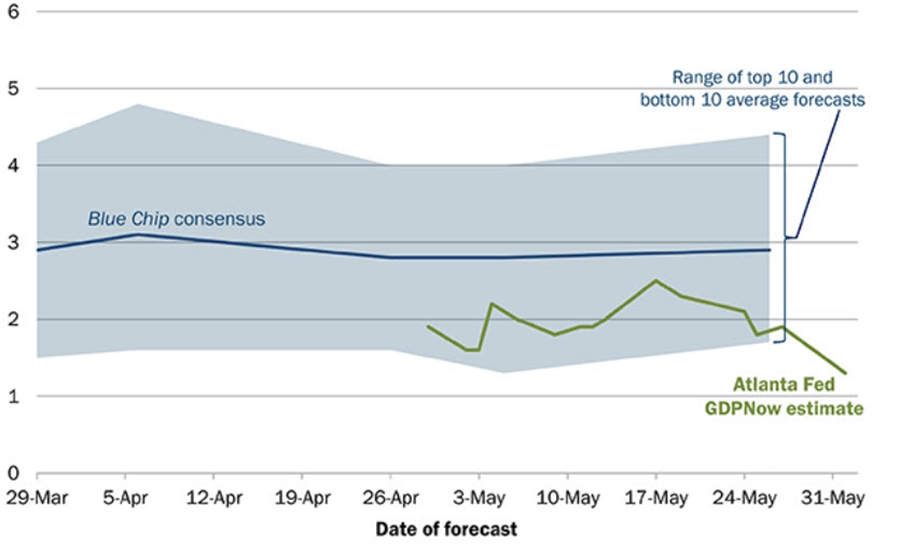

The consensus is just under 3% for Q2 US GDP but the Atlanta Fed tracking estimate is well below that now, at 1.3%. It was lowered from 1.9% following today's economic data.

"After this morning's Manufacturing ISM Report On Business from the Institute for Supply Management, and this morning’s construction spending report from the US Census Bureau, the nowcasts of second-quarter real personal consumption expenditures growth and real gross private domestic investment growth declined from 4.7 percent and -6.4 percent, respectively, to 4.4 percent and -8.2 percent, respectively," the latest report says.

We're still about 2 months away from the very first print on Q2 GDP so I wouldn't worry too much but a series of weak reading from here raises the possibility of a technical recession. To be honest, that would be more of a political event than a market one because of special factors in the data.