Consider this:

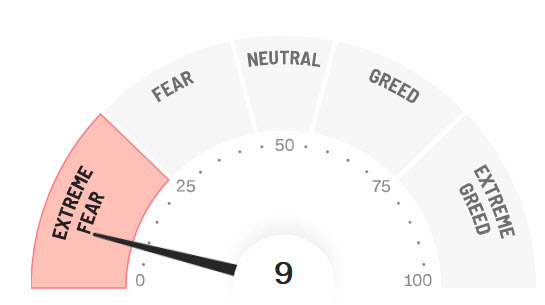

The Fear & Greed index from CNN is at 9, which is extreme (though not as extreme as last week).

The S&P 500 is down 1.1% at the open, which may be a final puke.

Now I'm mindful of the massive amounts of leverage and easy money that pumped up the market and I believe we're in a tech bust now, but there's a case for a bounce here.

- Barring a miracle rally today/tomorrow, we're going to be in a 7th consecutive week of declines in US stocks. We've only had 8 twice since at least 1997, in October 2008 and March 2001

- The composition of yesterday's selling. The 'defensive' stocks were hammered (-8%), like Clorox and Campbell's Soup. That looks like Mom & Pop investors going to cash.

- Junk stocks held up ok. That -- to me -- looks like funds covering shorts. That's deleveraging.

Again, bottoms are impossible to predict and that's certainly not something I would ever call. Sometimes they come in whimpers, sometimes they come in 7% drops with circuit breakers.

My point is that sentiment is really bad right now and that's generally something to lean against rather than go with.